The investment world’s ceaseless quest for three-letter shorthand for jargon has now delivered CDI, or cash flow-driven investment – the younger sibling of liability-driven investment.

Though consultants have been talking about CDI for some time, in reality it is still in its infancy. But talk to any pension fund manager, and you will quickly find that having the ability to pay their pensioners at the end of each month is really what matters most.

A pension fund should think of itself as being a business, or at least it should operate like one

Managers look at several key indicators, and of course investment performance is one, but the most critical is the cash flow. In this they are like any other enterprise, and it helps reinforce a message heard from thoughtful pension fund managers: that a pension fund should think of itself as being a business, or at least operate like one.

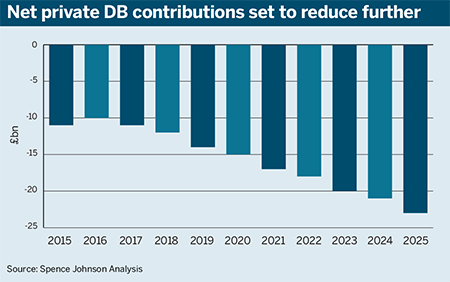

Cash flow is becoming more important every year. As the chart below shows, aggregate net contributions to UK private sector defined benefit schemes turned negative in 2012-13, and net contributions will become increasingly negative, to the tune of £23bn a year by 2025.

Pension freedoms and the ability to offer members transfers from DB to defined contribution schemes has further complicated the cash flow picture.

Members of DB schemes are permitted to transfer the pension wealth from a DB to a DC arrangement and this creates uncertainty for schemes as to when they might have to pay out members’ transfer values.

Cash flow will dictate investment strategies

As the UK DB market becomes increasingly cash flow negative, there will be significant implications for investment policy. Schemes, consultants and asset managers are adapting to this in a variety of ways.

Schemes have largely been concerned with the absolute value of their assets relative to their liabilities, and for this reason LDI has firmly established itself as a core part of the DB investment landscape.

However, LDI strategies will not necessarily offer the liquidity needed to pay out the liability cash flows when they fall due. As schemes close and turn cash flow negative, the need for managing the liquidity needed to pay member benefits becomes more important.

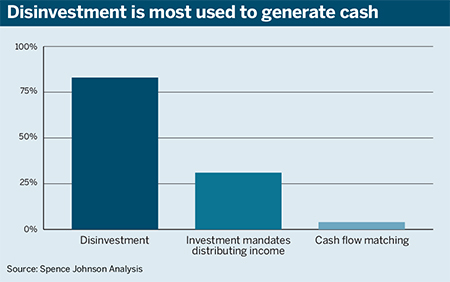

The results of a recent survey of DB pension funds identified three different broad methods used by schemes to finance negative cash flows: disinvestment; investment mandates distributing income; and cash flow matching.

The majority disinvest: 83 per cent of schemes finance negative net cash outflows through divestment of their assets. A further 31 per cent of schemes aim to generate the cash flow needed to meet liability payments through investing in income-generating mandates.

Which investments can cash flow negative schemes turn to?

Defined benefit pension funds will face significant pressures in 2017, including market uncertainty and potentially increased volatility. An additional issue many funds will have to grapple with is how to manage their investments as the scheme matures.

Only 4 per cent of schemes stated that they were using a cash flow matching approach. This type of strategy involves managing investments on a buy-and-maintain basis, with coupon and redemption payments timed to match the scheme’s liability outflows.

Some strategies may make significant use of illiquid assets. Several consultants and managers are innovating in this space, taking the view that use of these strategies will become more popular as the UK DB market moves deeper into cash flow negative territory.