I often catch people talking about the ‘shrinkage’ of defined benefit. There are lots of things about this market that are shrinking: memberships are shrinking; the number of open DB schemes is shrinking.

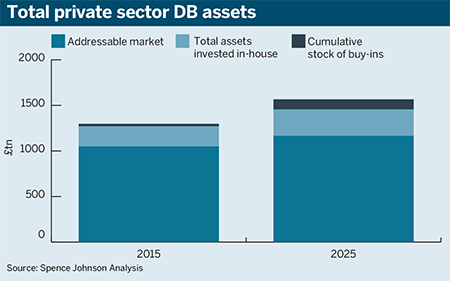

But on the most important measure – assets – it is not shrinking at all. In fact, it will continue to grow for many years to come. We predict that the total value of private sector DB assets will exceed £1.5tn by 2025, up from £1.3tn in 2015. This represents growth of nearly 2 per cent each year.

The amount of the DB assets managed by external asset managers will grow

It is possible that the predictions of shrinkage are coming from asset managers who are understandably fearful of the loss of their assets under management. And some elements of this asset base will be in decline; the equity assets will shrink, obviously, UK assets will shrink, the actively managed assets may shrink.

But the total pool of UK DB assets managed by external managers will rise.

This holds true even after you allow for the assets that will switch to the insurance buy-in market, and the growth of assets that in future will be managed by in-house investment management teams, particularly by larger pension schemes.

The addressable market to external asset management teams is expected to grow to £1.17tn by 2025 from £1.05tn in 2015.

What happened down under

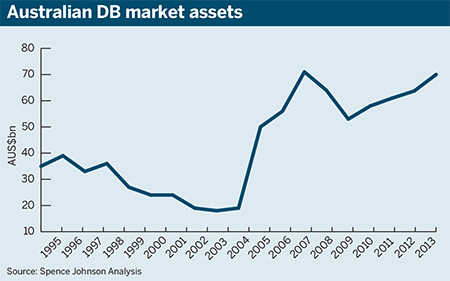

It is helpful to look abroad at this point. The patterns in the Australian and US DB markets support the view that the often predicted shrinkage of DB assets will not happen.

In both countries we are often told DB is closed, if not actually dead. Ask an Australian in the street about DB and they will say they thought it went extinct many years ago.

Yet in fact, as can be seen from the chart below – and the US equivalent shows a similar upward pattern – Australian DB assets have actually grown in terms of assets, despite being mostly closed.

DC still has way to go

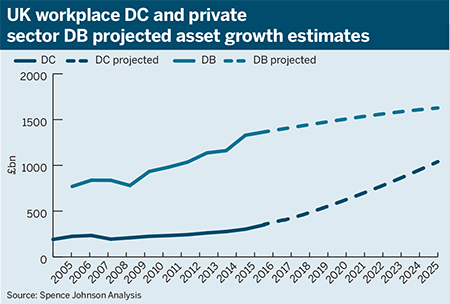

In addition, the defined contribution market here in the UK will not catch up with DB any time soon.

Assuming you use a sensible ‘workplace’ focused definition of DC, the assets in this category may grow at around 13 per cent a year to reach £1tn by 2025 after allowing for investment growth of 5 per cent a year, but DC assets will still be much smaller than DB by that date.

And this is just looking at DB private sector assets. When you add in local government, the DB asset pool will rise further still. We expect LGPS assets will grow at an average rate of 9 per cent a year between 2015 and 2025, and reach a total value of £488bn.

The faster growth of Local Government Pension Scheme assets relative to private sector DB assets is due to a number of reasons. The younger maturity profile of the LGPS relative to private sector DB means net contributions will be greater than for the private sector, and this allows the schemes to invest in more aggressive, higher-yielding asset classes.

The lower costs associated with the pooling of LGPS, and the expected increase in internal asset management will also reduce a drag on growth.

Magnus Spence is managing director of research provider Spence Johnson