Although there are nuances between different markets, a derisking trend continues to be pervasive across Europe.

Equity strategies continue to suffer while fixed income and liability-driven investment strategies are the main beneficiaries.

Fixed income strategies continue to see large net inflows across most DB markets in Europe

The large net outflows from government fixed income from defined benefit schemes in most markets can be associated with the search for yield.

But when you compare these patterns across Europe, it is clear that pension schemes in different markets are responding in different ways, especially when you look at fixed income strategies in more detail.

The four main asset class trends can be described as:

-

Equities continue to see net outflows across most European DB markets. This has broadly been part of the derisking story as DB markets mature. This is most acute in the UK. In the Netherlands, the continued growth and dominance of fiduciary management and coinciding growth in the use of internal asset management teams are important contributing factors to these net outflows.

-

Appetite for investment management-designed LDI, multi-asset products and solutions such as multi-asset diversified growth funds and LDI has been strongest in the UK, where the large number of smaller pension funds are seeking off-the-shelf solutions.

-

Some property and alternative asset classes can offer cash flow-matching characteristics and higher yields than traditional asset classes. Therefore, flows into such strategies are partially driven by the desire of pension funds to match liabilities, as well as the search for yield. Large net flows into property from German DB schemes can be explained with the search for yield, and also regulatory considerations affecting German funds.

-

Fixed income has traditionally been the main beneficiary of the derisking flows out of equities, offering greater liability-matching characteristics and more stable returns than equities. Fixed income strategies continue to see large net inflows across most DB markets in Europe.

How DB schemes invest in fixed income

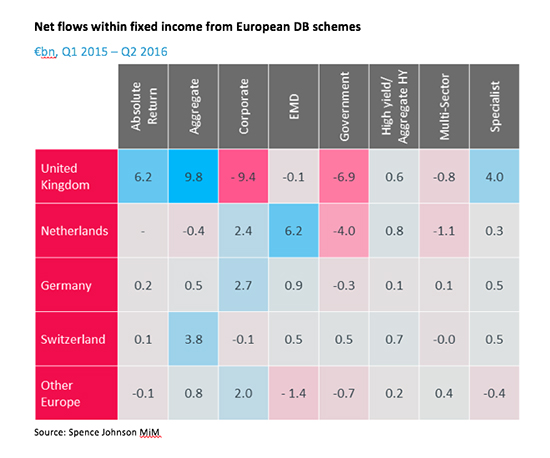

The table below shows the net flows in €bn within fixed income from European DB schemes, from Q1 2015 to Q2 2016. The largest positive (blue) and negative (red) numbers are highlighted.

This table shows three broad fixed income approaches pension funds are taking in their hunt for yield. Note that these approaches are not mutually exclusive:

Data crunch: Why DB schemes will change their investments

The investment world’s ceaseless quest for three-letter shorthand for jargon has now delivered CDI, or cash flow-driven investment – the younger sibling of liability-driven investment.

-

Climbing the credit spectrum: we have seen net outflows from government fixed income strategies from a number of markets, but especially from the UK and the Netherlands. Schemes in the Netherlands appear to be turning to emerging market debt, credit and high yield. For German schemes, the focus appears to be on credit and EMD, while Swiss schemes are allocating to aggregate and high-yield bonds. It appears UK schemes are instead accessing credit through aggregate, absolute return multi-sector strategies, as well as alternative credit through specialist fixed income strategies. Buy-and-maintain credit strategies may be slipping through this definitional framework into ‘undefined’ fixed income.

-

Accessing illiquidity/complexity premiums: Some pension funds are searching for yield in the more ‘complex’ or illiquid space, through specialist fixed income strategies. For example, we have seen substantial net flows into private debt strategies from UK DB schemes.

-

Rotational credit/high-yield beta: The large net inflows into absolute return fixed income from UK DB schemes have largely been concentrated in multi-sector absolute return strategies, which can be seen as sitting under the multi-asset credit umbrella. Diversified across a range of asset classes within fixed income, these strategies attempt to generate enhanced returns through sector rotation.

Magnus Spence is managing director of research company Spence Johnson (part of Broadridge)