The smart beta market has earlier origins, but it was in the 2000s when products emerged that targeted better risk-adjusted returns through analysis of correlations and covariance within portfolios.

Together with more sophisticated factor approaches that primarily target enhanced returns, these two product sets make up today’s smart beta market.

In 2014, we predicted that the smart beta market would grow at an annual rate of 31 per cent over the five years from 2013-2018, and this remains one of the largest annual growth predictions we have ever made in our research on different institutional markets and product families.

It appears that European fund-based smart beta has grown at 32 per cent.

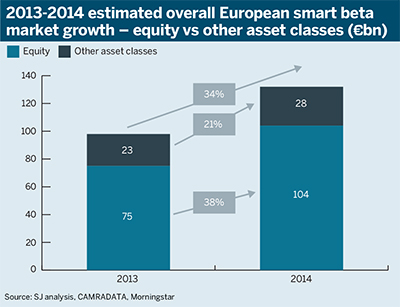

As shown in the first chart, much of the growth in the market continues to be focused on equity smart beta products. Bond smart beta also showed a strong growth over the year but from a much lower base.

The growth of the bond market is not as strong as we expected, suggesting investors continue to struggle with the greater complexity and smaller product set on offer in the smart beta bond space.

The overall ‘smart beta’ label belies the diversity of product and approach types that it is applied to. These product differences reflect the variety of demand profiles of the institutional and retail investors that are driving the rapid growth of this market.

The overall ‘smart beta’ label belies the diversity of product and approach types that the label is applied to

Our segmentation of the market reflects the wide range of providers offering both different investment approaches and different types of product within the European smart beta market.

We continue to classify the market in terms of three main approaches that asset managers can take when constructing products:

1. Advanced beta – a wholly asset manager-led approach, often close in design to traditional active ‘quantitative’ strategies.

2. Advanced index – rules-based indices designed in-house by asset managers.

3. Alternative index – these approaches are based on asset manager replication of third-party indices.

The products themselves can be classified as either:

• Return products – where the objective is to offer investors enhanced returns through exposure to market factors such as value, growth or momentum;

• Risk products – which do not explicitly target enhanced returns, instead their objective is to offer better risk-adjusted return through volatility reduction and diversification.

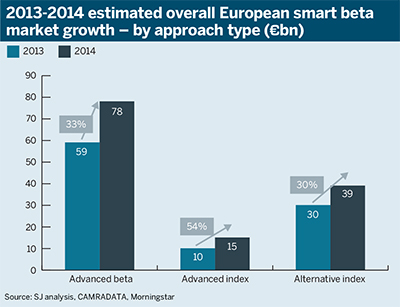

The two largest parts of the market are advanced beta and alternative index funds, as is shown in the second chart. In 2014 they both grew at the same rate.

Although our current estimates suggest that only around 40 per cent of this growth was generated by new flow, compared with 60 per cent of the growth in the alternative index market, it nonetheless points to a continued strong demand for more sophisticated advanced beta, and indeed advanced index, solutions among European investors.

This suggests that, although cost reduction continues to play an important role in driving demand for smart beta products, other drivers, such as improvements in return and diversification and reduction in risk, often outstrip cost reduction as key drivers of demand in certain segments of the market.

Magnus Spence is managing director of Spence Johnson