It seems logical that long-term savings should be invested in long-term assets, and property would seem a candidate for this type of investment.

We have recently carried out research for the Investment Property Forum to explore the current and future scope for property investment in defined contribution schemes in the UK. Our conclusion is that property investment in DC will grow, but considerable barriers still remain.

Our latest estimate is that the UK DC workplace market holds £338bn in assets. We have projected that the overall annual rate of asset growth will be 10 per cent over the next 10 years, and that UK DC assets will reach £871bn.

It has been clear for some time that the barriers to illiquid investments by DC schemes are not regulatory, but… structural and behavioural

We estimate that 30 per cent of all DC schemes currently invest in property, either through property funds themselves or via multi-asset funds.

As schemes fall in size then so does the popularity of property investment: across mega and large schemes, popularity averages 51 per cent.

Property will attract inflows

Where today there are 30 per cent of schemes invested in property, we forecast that this will rise to 40 per cent over the next 10 years.

We estimate that 1.8 per cent of workplace DC assets, including those of smaller schemes, are currently invested in property. We think that allocations to property will grow, both through property and multi-asset funds.

Overall, we anticipate it will rise from the current 1.8 per cent to 5.4 per cent in 2026. By comparison, UK defined benefit scheme investment in property has remained at around 5 per cent for the past 10 years.

In total, we now think there are £6.2bn of property assets in workplace DC today. Most of this is in the largest schemes.

Our conclusion is that there will be £47bn in property investment by DC schemes in 2026. The majority of these property assets will be held by mastertrusts.

Diversification drives alternative investment

Most schemes that we spoke to as part of this research told us that what they wanted to achieve from property investment was diversification, followed by a desire for long-term investment. Also mentioned were risk diversification and non-correlated returns.

Virtually all property investment in DC is done through pooled vehicles, both real estate investment trusts and other daily traded pooled funds. Other than within small self-administered schemes (whose property investments we have chosen to exclude from this study), there is little ‘direct’ property holding that we are aware of.

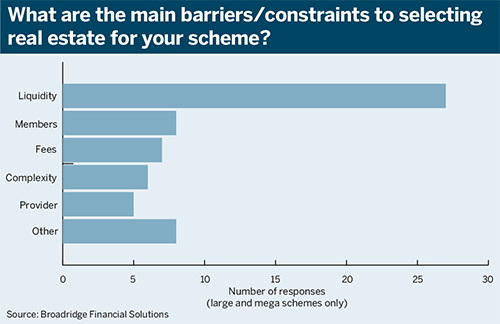

The main reason why schemes will not invest in property, or will not increase their investment, is the lack of liquidity that this asset class offers, as shown in the chart below.

Liquidity issues should fade

It has been clear for some time that the barriers to illiquid investments by DC schemes are not regulatory, but – as the Law Commission described it in its 2017 report – “structural and behavioural barriers within the pensions industry”.

A key issue is the lack of scale in DC, since diversification – for example into property – is most effectively achieved within a portfolio of sufficient size.

The current average asset size of larger DB schemes (those with more than 5,000 members) is £3bn.

In DC the equivalent average is below £400m, eight times smaller than DB. Growth in the DC asset base in coming years will gradually erode this gap, and make illiquid investment a more practical option.

Magnus Spence is managing director of global distribution solutions at Broadridge Financial Solutions