All Costs and charges articles – Page 17

-

Opinion

OpinionSelect committee’s new inquiry misses the point

From the blog: It is bizarre that the Work and Pensions Committee is questioning whether people understand the cost and value for money of their pension products when the Financial Conduct Authority has only just published research that answers their question.

-

News

Select committee launches costs and transparency inquiry

The Work and Pensions Committee is to conduct an inquiry into transparency in the pensions industry, questioning whether individuals are able to understand the cost, performance and value for money of their pension products.

-

News

Mastertrust transfers and charges blasted in ‘worst in pensions’ study

Two of the UK’s largest mastertrusts have been named the worst performing providers in pensions over high charges and slow transfer processes.

-

News

NewsMandatory tenders welcomed by pensions industry

UK pension schemes will be required to conduct competitive tender processes before hiring their first fiduciary manager, under recommendations set out by the Competition and Markets Authority on Wednesday.

-

Opinion

OpinionIDWG cost disclosures are only the beginning

The code submitted by Chris Sier’s working group on cost disclosure should make a material and positive difference to the industry, writes the Society of Pension Professionals’ president Paul McGlone, but schemes have an obligation to make use of this new information.

-

Features

Should the FCA set a drawdown charge cap?

The Financial Conduct Authority’s final report for its Retirement Outcomes Review focused on the challenges facing drawdown consumers.

-

Opinion

OpinionMaking data count – how to use the IDWG cost code

From the blog: Following nine months of detailed work by the members of the Financial Conduct Authority’s Institutional Disclosure Working Group, new cost data templates will, for the first time, provide an industry-agreed, consistent approach to collecting this important information.

-

News

NewsFCA recommends investment pathways for drawdown

The Financial Conduct Authority has proposed that pension providers are required to develop three ready-made investment pathways to help confused drawdown customers, but has shied away from imposing a charge cap on the products.

-

Opinion

OpinionTo transition or not to transition, that is the question

Premier Pensions’ Girish Menezes explains what trustees should take into account when it comes to transitioning to a new administration provider.

-

News

Disclosure standard aims for strengthened trustee buy side

Investment consultants could be required to disclose scheme data allowing clients to judge the quality of their advice under a new performance framework, which has already attracted positive early statements from two top 10 firms including 'big three' member Mercer.

-

Opinion

OpinionMistakes of annuity regime are being repeated

From the blog: The willingness of government and regulators to take a pragmatic approach to so-called pensions freedom will be tested over the next few weeks.

-

News

Lack of trustee engagement leads to higher fees, CMA finds

The Competition and Markets Authority has turned its attention to the negotiation abilities of trustee boards, with a working paper that highlights the benefits of engaging third-party oversight of consultants or fiduciary managers.

-

Features

Are diversified growth funds the place to be?

Analysis: Experts remain divided over the value offered by diversified growth funds. While DGFs offer a source of return that comes with reduced risk and daily pricing, they have come in for criticism in recent years over a perceived lack of performance and value.

-

Opinion

OpinionDoes the DC charge cap hinder value for money?

The focus on costs in recent years has led to a number of trends that may not be in the long-term best interests of members, writes Redington’s Jon Parker.

-

News

Now Pensions default struggles as industry lacks standardisation

Now Pensions has the worst performing default fund of any major defined contribution provider, according to a new report by product review company Defaqto.

-

News

FCA tackles information deficit with new rules and consultation

The Financial Conduct Authority has published new rules on the duties of fund managers and is launching a consultation on proposed rules and guidance for improving fund information for investors.

-

News

PwC probed on Carillion fees and conflicts

MPs have grilled PwC partners on fees and the safeguards the accountancy firm put in place to prevent conflicts of interest arising from its various roles regarding collapsed contractor Carillion.

-

Features

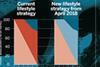

FeaturesJLR drives down costs with DC strategy refresh

UK automotive stalwart Jaguar Land Rover has embarked on a complete overhaul of its defined contribution offering in a bid to drive down costs and improve member outcomes.

-

News

IDWG chair calls for reform by April

PLSA Investment Conference 2018: Chris Sier, chair of the Financial Conduct Authority’s Institutional Disclosure Working Group, has called for the introduction of reforms promoting asset management transparency by the beginning of April.

-

Opinion

OpinionCost disclosure is only valuable if you know how to use it

Cost disclosure will give the industry the injection of transparency it has needed for years – but what to do with the new data? John Simmonds of CEM Benchmarking outlines a strategy for making sense of costs.