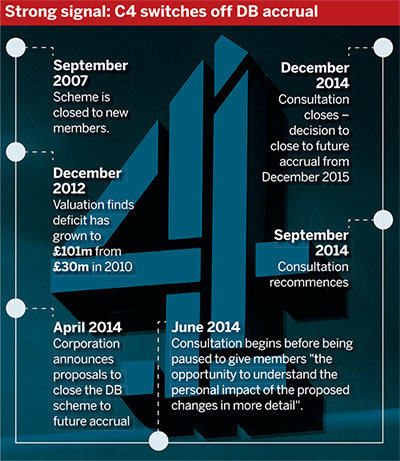

Channel 4 is offering defined benefit members enhanced pension contributions for five years after it closes the scheme to future accrual at the end of 2015, as funding levels deteriorate.

The broadcaster began consulting on the closure in June last year, before it was paused to give members “the opportunity to understand the personal impact of the proposed changes in more detail”.

The consultation recommenced from September until December, when it was decided the scheme would close in December this year and members would be given the option to enter the defined contribution section.

DB represents less than 25 per cent of the Channel 4 schemes’ overall membership.

A spokesperson for the scheme said: “Following a thorough consultation with members, Channel 4 Corporation has taken the decision to close its DB pension scheme to future accrual on December 31 2015 to protect against further deterioration in the funding deficit.

“Members will be given the opportunity to join the DC pension scheme with an enhanced contribution from the corporation for five years and will maintain some benefits of the DB scheme following members’ suggestions.”

And Invensys offers sweeteners to active members moving to DC

Engineering company Invensys closed its DB scheme to future accrual this week, but has bolstered other associated benefits for 350 members.

Schneider said it would review the company’s pension arrangements when it acquired Invensys. It then consulted on closing the DB scheme before ceasing future accrual on March 31 2015.

The 350 active members of the scheme were given the option to join the Schneider Electric DC Trust.

Active members were given a 2.3 per cent increase in final pensionable salary, additional early retirement flexibility and a late retirement option allowing them to delay taking their benefits until after age 65 – as well as a guarantee on the minimum size of their pension.

In a newsletter to scheme members Kathleen O’Donovan, chair of trustees at the Invensys scheme, said the membership had opposed scheme closure.

She added: “The rules of the scheme do allow the company the right to exclude any group of members from active accrual in the scheme, so in making the changes our powers as the trustee were very limited.

"However, we talked to the company throughout the consultation process. Following members’ requests, and with our support, the company has agreed to a number of improvements for members, including the option to defer retirement benefits beyond age 65.”

The DC scheme has an age-related contribution-matching structure which ranges from 3-6 per cent from employees and 5-13 per cent from employers. Channel 4 did not give details on the enhanced contribution rates offered to members transferring from the closing DB scheme.

The spokesperson added that members would be given access to an independent financial adviser, but refused to comment further on what other DB benefits affected members would retain.

Paul Houghton, partner at consultancy Barnett Waddingham, said offerings made to members at the closure of a DB scheme were generally divided into two types: retaining some DB benefits or improving the attractiveness of the “replacement vehicle”, typically a DC scheme.

“A [DB] pension scheme often provides more than just the core benefits,” Houghton said, citing death-in-service as one example.

“Anything that’s different between an active and deferred benefit may be offered,” he added.

Members will be given the opportunity to join the DC Pension Scheme with an enhanced contribution from the corporation for five years and will maintain some benefits of the DB scheme following members' suggestions

Channel 4

Houghton said additional contributions into the new arrangement are often added as a “sweetener”.

“The other thing is the replacement vehicle – almost always a DC scheme. You may see some kind of enhanced contribution going in.”

Calum Cooper, partner at consultancy Hymans Robertson, said the end of contracting-out next year was leading increasing numbers of DB schemes to close to future accrual.

He said: “We’re at the point now where about a third of schemes are closed and I think we’ll reach the halfway point in the next year.”

However, he added the decline in DB schemes was not necessarily bad for members.

“There’s a perception that DB is always better than DC, but now there’s an opportunity for employers to reposition DC in people’s minds.”

He said retirees without a spouse, suffering from poor health or planning to leave money to their children or grandchildren may well be better off with a DC pension.