All Aon articles – Page 18

-

Opinion

Are DGFs a good investment for schemes amid strong equity performance?

Kevin Frisby from LCP, JLT Investment Consulting’s Allan Lindsay, Axa IM’s Yoram Lustig, HR Trustees’ Giles Payne, Aon Hewitt’s Ryan Taylor and Bruce White of LGIM discuss whether diversified growth funds are a good investment for schemes given the strong performance of equities, in the second of this four-part panel debate.

-

News

IBM adds cat bonds to mix as it diversifies return-seeking assets

IBM Pension Plan has invested £60m in catastrophe bonds as it decreases its exposure to higher-risk assets and focuses on investments that will provide a diversified source of return.

-

Opinion

How can schemes judge DGF performance?

Kevin Frisby from LCP, JLT Investment Consulting’s Allan Lindsay, Axa IM’s Yoram Lustig, HR Trustees’ Giles Payne, Aon Hewitt’s Ryan Taylor and Bruce White of LGIM discuss how schemes can measure the performance of diversified growth funds, in the first of a four-part panel discussion.

-

News

Smaller schemes combine service provision to reduce legacy burden

Leading benefit consultancies have reported more small to medium-sized schemes are bundling services under a single provider in response to a growth in legacy arrangements and to benefit from economies of scale.

-

Features

USS revamps covenant assessment model in face of funding challenge

The Universities Superannuation Scheme has opted for a more thorough covenant assessment due to changes in higher education funding and an expected increase in its deficit from this year’s triennial valuation.

-

News

IASB proposal could hit sponsor-scheme funding strategies

A proposed change to pensions accounting guidance around surpluses could lead to trustees having to renegotiate their financing arrangements with employers and shifting towards non-cash vehicles.

-

News

Schemes have scope to delve deeper into illiquids, but confidence lacking

Defined benefit schemes are showing increased interest in illiquid alternatives as they hunt greater yield and diversification, but many lack sufficient resources and the confidence needed to execute such investments.

-

Features

Imperial Tobacco ups employer contributions after funding drop

Imperial Tobacco has increased contributions to its UK defined benefit scheme to boost its winding-up funding level, which has dropped by 12 percentage points, according to its latest valuation.

-

Features

Barking and Dagenham plans social housing investment to hedge inflation

The London Borough of Barking and Dagenham Pension Fund plans to invest around £25m in social housing in order to hedge against inflation and diversify away from traditional assets.

-

Opinion

Avoiding a talking shop: how to get more out of your trustee meeting

Any other business: Economist and diplomat John Galbraith once said: “Meetings are indispensable when you don’t want to do anything.” But with fiduciary duty weighing heavily on trustees, board meetings must be a forum for effective decision-making.

-

Opinion

Where do we stand on pot-follows-member after the Budget?

Aon Hewitt’s Geraldine Brassett in this edition of Technical Comment discusses the prospects for the government’s small pension pot consolidation reform following the historic Budget changes, and how the scheme could work.

-

Features

How the DA pensions bill could affect your scheme

Schemes have been left pondering how their benefit structures would be considered under the the government’s latest pensions bill, which codified three types of pension scheme, including “shared risk” schemes.

-

Features

Islington to build on residential property bet in alts push

Islington Council’s pension fund plans to reduce its allocation to equities and diversify further into alternatives, in a stated desire to gain greater and more stable returns.

-

News

Buy-in market predicted to reach new heights

The amount of scheme liabilities underwritten by insurers is expected to reach a record high this year as buy-ins become more affordable and scheme confidence grows, derisking consultants have said.

-

News

Collective schemes to be enforced by valuation and reporting framework

Collective schemes – which pool members’ assets and risk – will have to comply with new valuation and reporting requirements, under initial proposals outlined yesterday in the Queen’s Speech.

-

News

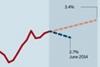

NewsGilt yield falls confound expectations and depress funding

Investment advisers have been taken by surprise by the recent drop in government bond yields which have inflated schemes’ liabilities and delayed derisking strategies.

-

Features

Second-tier wins out against core property investments

The ground underneath the bricks and mortar asset class trembled after the downturn in 2008, when a housing and mortgage implosion triggered the global financial crisis.

-

Features

LPFA reports doubling in employers needing covenant review

The London Pensions Fund Authority’s risk-based approach to setting contribution rates has identified around twice the number of employers that may need to provide greater solvency guarantees after its recent valuation.

-

Opinion

Criticism of fid man selection and transparency is unfounded

Aon Hewitt’s Sion Cole mounts a robust defence of the fee structures, manager selection and performance metrics at play in fiduciary management mandates, in the latest Informed Comment.

-

Features

Lancashire increases employer contributions to mitigate maturing membership

Lancashire Pension Fund has added lump-sum payments to its annual employer contributions to make up for reduced cash flow from a declining active membership.