Defined benefit (DB) pension schemes’ aggregate surplus position declined in December as volatility hit equity and bond markets.

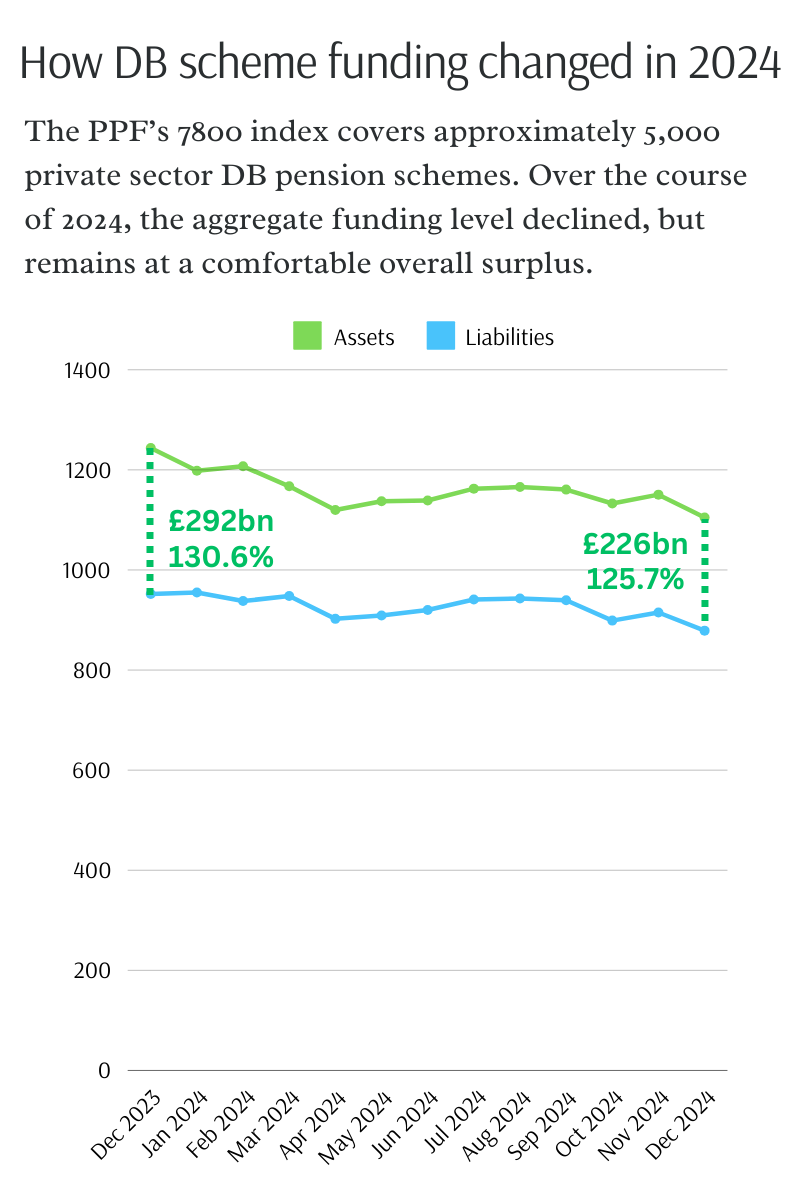

The Pension Protection Fund’s (PPF) 7800 index of private sector DB schemes had £1,105bn in assets against £879bn in liabilities, giving a £226bn overall surplus at the end of December.

This also gave an aggregate funding ratio of 125.7%. While this figure was unchanged compared to November, the surplus figure was more than £9bn lower.

Shalin Bhagwan, the PPF’s chief actuary, said the figures illustrated the impact of rising bond yields on both asset and liability values. Bond prices – which move inversely to yields – fell amid concerns that inflation was remaining elevated and the US Federal Reserve planned to delay interest rate cuts.

Jaime Norman, senior actuarial director at Broadstone, said 2024 had been a relatively steady year for DB pension scheme funding levels, but the volatility in December was likely to continue through the first weeks of 2025.

“These movements could be good for schemes that are still poorly funded or with low levels of hedging, but it is likely to be unsettling for pension scheme members,” he said.

“2025 looks set to be another turbulent yet across global markets amid increasing geopolitical risk and continuing macroeconomic uncertainty,” Norman continued.“The job for trustees will be managing investment risk and monitoring employer covenants to ensure the long-term security of member benefits.

“The insurance bulk annuity market is likely to see significant demand from pension schemes again in 2025 as employers look to de-risk and as more entrants and superfunds offer increasing levels of choice.”

Alex Oakley, bulk annuity transaction manager at Standard Life, added: “As we start a new year, scheme funding levels remain strong, with many finding themselves closer to buy-in or buyout than anticipated, allowing them to consider locking in these strong positions.

“While 2025 has started with markets experiencing a surge in gilt yields, the impact on aggregate funding levels is less pronounced than when gilt yields rose in 2022 as many schemes have increased their hedging levels since then.

“In this busy market, trustees continue to focus on tailoring de-risking strategies to secure long-term objectives and capitalise on favourable funding positions, including safeguarding member benefits and preparing for endgame solutions, and insurers continue to play a crucial role in providing solutions to support schemes with their de-risking objectives.”