All articles by Tom Dines – Page 8

-

News

NewsSecondary annuities: Govt starts putting down advice parameters

Many pensioners hoping to sell their annuities on the open market will be required to seek financial advice before doing so, the government has announced, as the industry awaits further detail on the structure of the secondary annuity market.

-

News

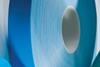

NewsScapa saves £600k through flexible retirement exercise

Adhesive tape manufacturer Scapa Group has saved around £600,000 by offering flexible retirement options to some deferred members of its defined benefit scheme, clearing more than £10m of liabilities.

-

News

DB funding pressure rises but scheme closures plateau

Data Analysis: The aggregate funding level of UK defined benefit schemes has deteriorated again despite asset allocation trends moving towards lower-risk investments, but the number of schemes open to new members has stayed level.

-

News

Voluntary saving is vital to avert poor pension outcomes

Data Analysis: Auto-enrolment and voluntary pension saving are critical to ensure good outcomes for UK retirees, a report looking at international replacement rates has this week has warned.

-

News

The Pensions Trust tackles state pension confusion

The Pensions Trust has updated member communications to prepare for the end of contracting out, as research has shown low levels of understanding about the state pension changes.

-

Opinion

OpinionAutumn Statement uncharacteristically quiet(ish)

From the blog: Once again the pensions industry pleaded with the chancellor to hold off on any further profound changes, only this time it looks like it got its wish… sort of.

-

News

Knowledge sets the bar in regulator's draft DC code

The Pensions Regulator is basing its leaner draft code of practice for trustees of defined contribution schemes on 'knowledge and understanding' requirements, which will mark out those in need of further training.

-

News

NewsM&S completes re-enrolment, experts warn of governance risks

Marks & Spencer Pension Scheme has successfully completed re-enrolment, having reached the three-year staging anniversary, but experts say schemes should review their processes to avoid tripping over nuances in the rules.

-

News

SPV helps Johnson Matthey reduce deficit by £145m

Johnson Matthey Pension Scheme has reduced its deficit by around £145m after taking a raft of measures to address its funding shortfall, including the creation of an asset-backed contribution vehicle comprised of third-party bonds.

-

News

NewsIs your scheme in the know about securities lending?

Investment experts have laid out the steps schemes should take to minimise risks when allocating to securities lending, and warned of the potential they face for illiquidity and loss of voting rights.

-

News

Annuity demand expected to resurge

Annuity sales will increase from this year despite the new pension flexibilities, as retirees recognise their need for a level of certainty in retirement, new research has suggested.

-

News

NewsPremier Foods eats away at deficit by more than £570m

Food manufacturing company Premier Foods decimated its IAS 19 deficit to £32.8m from £603.3m since December 2013 thanks to its hedging strategy and a change in discount rates.

-

News

NewsTrinity Mirror reviews advisers ahead of DC default appraisal

Trinity Mirror Pension Plan has carried out a consultant review ahead of an appraisal of its defined contribution default fund, spurred by the introduction of the freedom and choice reforms.

-

News

GMPF-LPFA venture closes first infra deal amid 'frothy' market

FT European Infrastructure: Greater Manchester Pension Fund has made the first investment of its joint venture with the London Pensions Fund Authority, but said high demand for the UK infrastructure market makes finding deals challenging.

-

News

Rebus reviews funding strategy in self-sufficiency drive

Rebus Pension Scheme is shooting for funding self-sufficiency with a review of its investment strategy aimed at boosting returns and diversification, but some commentators have raised questions over its loose definition.

-

News

Northumbria Police pays out £250k to compensate pension loss

Trustees should keep their distance from members' employer disputes, lawyers have said, after Northumbria Police was required to pay out more than £250,000 for discrimination and pension loss, but others argue open communication is critical.

-

News

QE placing pension systems in jeopardy

Data Analysis: Quantitative easing has exacerbated the movement of pension risk from employers to individuals, placing the future of the entire system at risk, according to a report published last week.

-

News

Fuzzy 'new normal' begins to emerge from pension freedom data

Gaps in the data on consumer behaviour following the freedom and choice reforms introduced earlier this year are creating a muddled picture of people’s choices, experts have said.

-

News

NewsEnvironment Agency reduces carbon footprint by 44%

The Environment Agency Pension Fund has reduced its carbon footprint by 44 per cent since 2008, as it looks to avoid the long-term financial risk of climate change.

-

News

Hackney seizes on EM value with £50m allocation

Hackney Pension Fund has taken advantage of recent market weakness and allocated roughly £50m each to emerging markets and multi-asset pooled funds in order to diversify its portfolio.