All The Pensions Regulator (TPR) articles – Page 75

-

Features

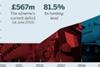

NESPF automates employer data submission to plug gaps

North East Scotland Pension Fund is working towards implementing a fully automated process for employers submitting member data, after narrowly failing to hit all the Pensions Regulator’s targets for common data accuracy.

-

Features

Regulator reports sharp rise in non-compliance as AE expands

The number of employers failing to comply with their auto-enrolment duties over two months to March 25 nearly matched figures for the entirety of 2013, as the amount of organisations auto-enrolling ramps up.

-

Features

FeaturesLafarge doubles contributions to cut deficit

Building materials manufacturer Lafarge has more than doubled its contributions to its UK pension fund after scheme and sponsor negotiated a beefed-up recovery plan to tackle the funding deficit.

-

News

Charge cap consultation ramps up governance, weakens employers

News analysis: Defined contribution scheme representatives will see governance responsibilities increase after the pensions minister announces further reforms to ensure members get value – with a backdrop of industry debate on the charges cap.

-

Features

SME achieves almost zero opt-outs after enrolling early

Chartered surveyor Dalcour Maclaren has secured a virtually entire take-up of its defined contribution plan since it auto-enrolled its small workforce last year, and now the company is looking to streamline administration of the scheme.

-

Opinion

Regulator: our call to AE action

Talking head: The Pensions Regulator’s Charles Counsell urges smaller employers not to leave their auto-enrolment obligations to the last minute, saying now is “no time for complacency”.

-

Features

AE non-compliance expected to increase as SMEs stage

News analysis: Consultants have urged employers auto-enrolling this year to ensure they are dedicating enough resources to the process, with the Pensions Regulator raising concerns about non-compliance.

-

Opinion

Why the reg’s DC code is near impossible for lay trustees

PMI president Paul Couchman takes aim at the regulatory burden of the new defined contribution code on lay trustees in particular, and argues it is “highly likely” more than one in four schemes are non-compliant, in this week’s Informed Comment.

-

News

Diageo: CDC could help overcome lack of member knowledge

NAPF Investment Conference 2014: Collective defined contribution could be a way forward for schemes trying to “give members what they want” and avoid burdening them with decisions, said Diageo’s director of pensions.

-

News

Education key as employers stretch to reach pension goals

News analysis: Companies need to better educate staff to encourage responsibility for pension saving, as research has highlighted a misalignment between employers’ goals and the outcomes of their defined contribution plans.

-

News

Isle of Wight bolsters governance ahead of LGPS reform

Isle of Wight Pension Fund has identified areas ripe for improvement in its governance, including more frequent funding monitoring, as local government schemes brace for next year’s reforms to the sector.

-

Opinion

How to build your risk committee

As more defined benefit schemes follow a derisking plan towards their end point, monitoring and managing risk grows ever more important.

-

News

Regulator's DC self-assessment tool gets cautious welcome

Industry figures have welcomed the governance 'nudge' provided by the Pensions Regulator's self-assessment tools, but questioned whether schemes can hold themselves to account.

-

News

How the pension fraud action group will tackle scam increase

The Pension Liberation Industry Group will develop a code of practice on pension transfers to protect trustees, as liberation schemes find new ways of targeting members.

-

News

Only seven in 10 DC members use the default

Data analysis: Fewer defined contribution members than expected are invested in default funds, new figures have shown, but experts anticipate this to increase as auto-enrolment continues to roll out.

-

News

Employers open to risk of reporting errors on contingent assets

News analysis: Employers have been told to approach the use of certain contingent asset funding deals with caution, after the Financial Reporting Council said solvency improvements could be cause for investigation.

-

News

Pensions regulatory gap 'unsatisfactory', DWP report says

News analysis: The regulatory gap between pensions and wider financial services needs addressing, a Department for Work and Pensions report has said, but ongoing reform is pushing the issue down the agenda.

-

Opinion

Regulator: ‘Balance’ key to our DB approach in 2014

Talking head: Interim chief executive Stephen Soper looks at what the Pensions Regulator has coming this year, including how its revised DB funding strategy will affect employers and schemes.

-

News

Bad data: how to diagnose and fix missing records

Schemes managers and trustees are given a step-by-step guide to making their data regulator-proof by Broadstone’s John Newman, in the latest edition of Technical View.

-

News

How the DB code of practice may affect your scheme

News analysis: Schemes should take a more integrated approach to investment, funding and covenant in their risk management, according to the Pensions Regulator’s consultation on its defined benefit code of practice.