All The Pensions Regulator (TPR) articles – Page 74

-

News

Ombudsman: pension liberation reports expected in a ‘few weeks’

The pensions ombudsman has said it should be publishing determinations on pension liberation cases within the next few weeks, with trustees hoping the reports will help them on difficult transfer decisions.

-

Features

NESPF beefs up governance to prep for Scottish LGPS reform

North East Scotland Pension Fund plans to establish a dedicated governance team – incorporating communication responsibilities – to deal with the increased workload produced by local government pension scheme reforms.

-

Opinion

Regulator: We’re stepping up the fight against scams that have shattered lives

Talking Head: The regulator’s Andrew Warwick-Thompson sets out the detail of the watchdog’s renewed push against pension liberation scams, which he reveals have resulted in one scheme member taking his own life when a promised lump sum did not materialise.

-

News

Covenant-lite market expands as small schemes digest DB code

Small and medium-sized employers’ pension schemes are finding greater access to pared-down, lower-cost covenant assessments following the Pensions Regulator’s revised defined benefit code of practice, which has increased focus on employer strength.

-

News

NewsKingfisher nears surplus following sponsor property deal

Kingfisher Pension Scheme has revealed that a funding deal with its sponsor, which sees it draw from income-generating properties, has pushed its funding level close to 100 per cent.

-

Opinion

OpinionEditorial: You're right from your side

One in seven trustees doesn't sound like a lot. But when you think that could be one person on every pension scheme board, the proportion starts to feel a bit more tangible.

-

Features

FeaturesSiemens shrinks deficit with asset-backed funding deal

Engineering and electronics company Siemens has set up a Scottish limited partnership for its UK defined benefit scheme to provide additional security for members, shutting a large part of its deficit and stabilising the company’s cash flow.

-

Opinion

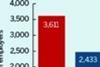

Six key graphs on the regulator's uphill task on scheme data

The Pensions Regulator last week released its annual record-keeping survey, which once again showed smaller schemes were falling behind their larger counterparts.

-

News

Revised DB code emphasises integrated risk management

The Pensions Regulator this week released a new code of practice for defined benefit schemes, focusing on trustees and employers working collaboratively on scheme funding.

-

News

Collective schemes to be enforced by valuation and reporting framework

Collective schemes – which pool members’ assets and risk – will have to comply with new valuation and reporting requirements, under initial proposals outlined yesterday in the Queen’s Speech.

-

News

NewsPPF targets transparency with insolvency levy changes

Schemes will be able to more precisely focus their efforts to reduce their Pension Protection Fund levy, following the lifeboat’s proposals to make its insolvency risk system more transparent.

-

Opinion

Regulator's corporate plan: AE, funding, and trustee training

The Pensions Regulator has laid out its corporate plan for the next three years, in which it sets out plans to review its approach to ensuring high standards of governance and administration for schemes. It will also seek to improve the knowledge and understanding of trustees.

-

Opinion

Regulator: Where DC schemes are failing legal minimum

Talking head: The Pensions Regulator’s Andrew Warwick-Thompson looks at the results of the watchdog’s latest governance survey, and highlights where schemes are particularly falling short.

-

Opinion

Regulator makes latest bid for transparency in case decisions

The Pensions Regulator has issued a six-week consultation on the procedure it follows in cases where decisions are made by the executive arm of the regulator.

-

Features

Half of schemes lack trustee training plan, survey finds

Two employers have explained how they make sure trustees are regularly trained, after a Pensions Regulator survey shows half of schemes do not have a training plan.

-

News

Regulator considers stringent testing for indy trustees to raise standards

The Pensions Regulator is considering requiring formal qualifications for independent trustees and trustee chairs, in order to raise governance standards, its executive director told delegates at Wednesday’s conference.

-

Opinion

The regulator’s anti-avoidance powers have not held corporate activity hostage

Gordons’ Matthew Ambler considers how the Pensions Regulator has wielded its anti-avoidance powers over the past decade, and what the impact has been on schemes and employers, in the latest Informed Comment.

-

Features

Mastertrusts call for governance standards to be made mandatory

Two of the country's largest mastertrusts have called for a legal standard to raise the barriers to entry for providers, as the industry evaluates the Pensions Regulator's assurance framework.

-

Opinion

Final mastertrust assurance framework released: key points

The Institute of Chartered Accountants in England and Wales and the Pensions Regulator have today released their final mastertrust assurance framework, including reducing the number and detail of control objectives to reduce burden on providers.

-

Features

LPFA reports doubling in employers needing covenant review

The London Pensions Fund Authority’s risk-based approach to setting contribution rates has identified around twice the number of employers that may need to provide greater solvency guarantees after its recent valuation.