All scheme mergers articles – Page 2

-

News

NewsPLSA ‘superfunds’ solution gets lukewarm reception

The Pensions and Lifetime Savings Association is calling on the government to facilitate consolidation while creating a regulatory framework for the creation of superfunds, but the proposal has seen a muted response.

-

Opinion

OpinionBringing pension schemes together

Editorial: The efforts made to outdo each other with yet another game, more champagne or an enormous plastic animal at the stand have reached a new level at the Pensions and Lifetime Savings Association’s Annual Conference this year.

-

Features

FeaturesStagecoach tightens governance reins with scheme merger

Stagecoach Group has merged one of its smaller pension plans with its £1.3bn defined benefit scheme, but the company has maintained a separate section for the smaller fund, keeping liabilities separate while potentially sharing some costs.

-

Opinion

OpinionHow to make your providers work harder

Competition in the asset management sector is under scrutiny in the Financial Conduct Authority’s market study, but schemes can act now to get a better deal, says Avida International’s Paul Boerboom.

-

Opinion

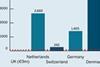

OpinionScheme fragmentation more stark in private sector than public

Data Crunch: The appointment last month of Edi Truell as the London Mayor’s new adviser on pensions and investments is part of an initiative, we are told, to amalgamate some of the country’s numerous public sector pension funds and aims to save billions of pounds through greater efficiencies, lower fees and improved returns.

-

News

How to get the best for your scheme in M&As

Any Other Business: Last week, oil giant Royal Dutch Shell announced plans to buy rival BG Group for £47bn and is widely predicted to be the first in a swath of deals across the sector.

-

Features

Imerys consults on ceasing DB accrual after merger

Mineral specialist Imerys is undertaking a consultation to cease accrual in its defined benefit pension scheme, following the completion of a scheme merger earlier this year.

-

News

Vodafone revisits scheme comms after bringing onboard 6,200 members

Vodafone is reviewing its communication strategy after a significant increase in the size of its defined contribution pension plan following auto-enrolment and an influx of members from its Cable & Wireless acquisition.

-

Features

Vodafone scheme completes CWW merger with £325m employer payment

Vodafone has contributed £325m to its defined benefit scheme as it completes the transfer of the Cable & Wireless Worldwide Retirement Plan, after purchasing the rival telecoms company in 2012.

-

News

Local authority schemes welcome government CIVs

Local authority pension schemes have come out in support of proposals to pool local government pension scheme assets into two common investment vehicles.

-

Features

FeaturesManagers’ examples on reducing risks from 2013

Year in review: Pension managers and trustees took a variety of measures to protect their members’ benefits, Pensions Week reported over the past year, from more efficient administration software to covenant safeguards.

-

News

LGPS given reform blueprint to cut costs

News analysis: Local government pension schemes are being called upon to increase governance and change investment structures to save taxpayers £1bn a year.

-

Features

FeaturesNuclear fund on course to claw back £1m merger cost

The Nuclear Decommissioning Authority is close to recouping the £1m it spent merging two schemes into the Combined Nuclear Pension Plan in a bid to save on administration and advisory costs.

-

News

Gwynedd presents merger plans to boost returns

News analysis: Gwynedd County Council Pension Fund has taken steps towards establishing a common investment vehicle with other Welsh schemes, as public schemes investigate consolidation to provide savings and higher investment returns.

-

News

NewsSaul outlines policy for strengthening through mergers

The Superannuation Arrangements for the University of London has detailed its merger policy as part of work to help achieve economies of scale across support staff pension schemes.

-

News

Chiltern funds target £2.5m merger saving

Oxfordshire, Buckinghamshire and Berkshire councils are in preliminary talks about merging their pension funds in an attempt to save £2.5m a year, as more local authority schemes club together to reduce costs.

- Previous Page

- Page1

- Page2

- Next Page