All scheme funding articles – Page 24

-

News

James Hutton Institute mulls DB closure

The James Hutton Institute is gearing up to begin negotiations with unions, as it proposes closing its career average scheme in favour of a defined contribution arrangement.

-

Features

Increased contributions for BA scheme rewarded by investors

The trustees of the New Airways Pension Scheme have agreed a new funding arrangement with sponsor British Airways, a move that saw share prices in BA’s parent company International Airlines Group soar by more than 5 per cent on Wednesday.

-

Opinion

OpinionMissing the bigger picture

Editorial: The importance of understanding pensions is well acknowledged by the industry. The need for guidance and advice is a ready source of commentary at any time of year, and the dangers faced by those approaching retirement without sufficient education are rightly the subject of much debate.

-

News

Company disclosures lack detail, report concludes

Companies need to provide more information on their defined benefit pension obligations, experts have said, after a study by Lincoln Pensions revealed a lack of clarity on many key issues.

-

News

NewsCBI requests reforms to ease DB burden on businesses

The Confederation of British Industry has called for a number of reforms to help tackle the problem of pension costs for companies, including access to illiquid assets and approaches to measuring deficits.

-

News

TPR and PPF call for muscular regulation

Both the Pensions Regulator and the Pension Protection Fund have called for more wide-ranging, interventionist regulation of defined benefit schemes, evidence published by the Work and Pensions Committee has this week shown.

-

Features

FeaturesStagecoach tightens governance reins with scheme merger

Stagecoach Group has merged one of its smaller pension plans with its £1.3bn defined benefit scheme, but the company has maintained a separate section for the smaller fund, keeping liabilities separate while potentially sharing some costs.

-

Opinion

OpinionUnpacking the proposed DB bill

Aries Insight’s Ian Neale gives us a primer on the defined benefit bill proposed by Frank Field MP, which promises to set a path for how the contentious issues will be tackled.

-

Opinion

OpinionThe Brexit effect on schemes and stats

The Society of Pension Professionals’ Hugh Nolan explains why making sense of financial stats can be tricky when Brexit is involved.

-

Features

PPF deficit figures presage hard times for funding and dividends

Analysis: Following the Pension Protection Fund’s news of yet another record deficit in defined benefit pensions, many schemes can expect to gear up for challenging funding negotiations, amid growing fears for company dividends.

-

Opinion

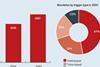

Data crunch: Small schemes, small problems?

Spence Johnson’s Magnus Spence asks why small pension schemes, which closed to accrual earlier than their larger peers, are slower to derisk.

-

Features

Salvation Army derisks as charities struggle with pension deficits

The Salvation Army has recently reduced risk in its UK defined benefit multi-employer scheme, having made efforts to tackle its pension deficit, but pension obligations are proving increasingly problematic for many charities.

-

Opinion

OpinionBad cases make bad law

Hugh Nolan from the Society of Pension Professionals sets out his views on the recent pension fund issues to hit the news.

-

News

NewsNational Milk Records cuts £6.2m with CPI switch

The National Milk Records pension fund has cut £6.2m from its deficit following a switch from the retail price index to the consumer price index as a means of calculating inflation-related adjustments to the fund.

-

News

NewsSelect committees: Philip Green has ‘moral duty’ to help fix BHS pension deficit

A joint report published by the Work and Pensions Committee and the Business, Innovation and Skills Committee found negligence caused BHS’s pensions deficit, and opened the possibility of increasing the Pensions Regulator’s powers.

-

News

CFOs pushed to increase focus on DB schemes

A new survey has found that 59 per cent of chief financial officers said they should become more involved with the management of their companies’ defined benefit schemes, following a steep post-Brexit DB deficit increase.

-

News

NewsDe La Rue extends recovery plan and ups bonds

Banknote and passport printer De La Rue has agreed an extended recovery plan with its pension scheme trustees after its most recent actuarial valuation showed an increased deficit of £252m.

-

Features

FeaturesFinal date set for Box Clever trustee and ITV showdown

Trustees of the Box Clever Pension Scheme and ITV were back in court last week, in the latest round of a four-year legal battle to force the broadcasting giant to help make good the fund’s £90m deficit.

-

News

NewsSmaller schemes dive into LDI pools

Smaller schemes are increasingly using liability-driven investment strategies, as the number of pooled mandates powers growth in the market, research this week from consultancy KPMG has shown.

-

Opinion

Leadership is needed for the future of DB

The Local Pension Partnership’s Susan Martin outlines the need for leadership in defined benefit schemes if they are to remain sustainable in the long term.