All Retirement articles – Page 23

-

Opinion

OpinionTreasury: Building on the success of the freedoms

Talking Head: Pension freedoms are off to a positive start, says the Treasury’s Harriet Baldwin, but individuals still need help finding financial advice.

-

Opinion

OpinionInnovation in a world of freedom and choice

The advent of freedom and choice does not mean reinventing the wheel; the solutions are already there, says AXA IM’s Stephanie Condra.

-

Opinion

The other glass ceiling: how women are being left behind on pensions

From the blog: Alongside concerns that women comprise a large but undervalued section of the workforce, a growing body of research warns they also risk getting a bad deal at retirement.

-

News

NewsThe future of DC? Nest unveils retirement blueprint

Government-backed mastertrust Nest has outlined its plan for providing members with an income in retirement, but experts have said the proposals’ application to today’s defined contribution market is limited.

-

News

NewsFindel forks out £2.3m to repair equalisation error

Findel Group Pension Scheme has paid more than £2.3m in past-service costs to make good an error in which a member benefit equalisation exercise was implemented incorrectly.

-

News

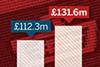

New peak for pension saving, focus turns to adequacy

Data analysis: Scheme membership has reached fresh highs among the UK population but industry experts are calling for greater government intervention to boost contributions and to stop individuals falling through the cracks.

-

News

Is 55 too young to cash in a DC pension?

The age at which members can access their pension pots should be increased, according to a white paper, but some experts say those in ill health should not be held back from drawing their cash.

-

Opinion

Cashing in unwanted annuities

Talking Head: Ros Altmann explains why, despite the questions around value, people selling annuities that are not working for them might be the best option all round.

-

News

Cultural norms could inform UK DC outcomes, PPI report shows

The Australian experience of defined contribution indicates UK pensioners could deplete their retirement pots too early, a report warns, but experts say what we can learn from overseas systems is limited.

-

News

Battle of growth v consolidation in DC market

Pension providers should cut costs by close to a third to capitalise on opportunities in the UK’s defined contribution market, a white paper has said, but consultants questioned the potential for new market entrants.

-

Opinion

OpinionGardner: How to achieve financial security in retirement

Talking Head: Redington’s Rob Gardner questions how we can calibrate investment strategies and saving behaviours with retirement income goals.

-

Opinion

Two workplace guidance steps to avoid member confusion

Mercer’s Mark Rowlands believes pension scheme members need more than a little advice to help them make the right decisions when nearing retirement.

-

News

More than half unlikely to take advice on pension access

Most retirees are unlikely to seek advice before withdrawing their pension, a survey has shown, as the industry wrestles with how to protect members in the new flexible pensions environment.

-

News

Industry mulls impact of Labour drawdown cap pledge

Analysis: Experts have raised questions about a possible cap on drawdown charges proposed by Ed Miliband last week, as the industry braces itself for the reforms and an uncertain general election outcome.

-

Opinion

OpinionEditorial: Well, in theory...

Some of the best minds in the pensions industry have spent the past 10 months trying to redesign defined contribution scheme investment. But some of that thinking is based on a faulty premise.

-

News

Why three in four say they will shun guidance guarantee

Only one in four over-55s intend to use the government’s free retirement guidance service, falling below one in 10 for women approaching retirement, in another sign of the challenge facing the system.

-

Opinion

Why annuities still play a crucial role in the post-Budget landscape

The announcement of the retirement reforms sent shock waves through the market last year. But MGM Advantage’s Andrew Tully explains why, where annuities are concerned, there is life in the old dog yet.

-

Opinion

How to battle pensions liberation in the new DC environment

Liberation scams are a growing tumour on the pensions industry, offering scheme members access to their money early at the cost of large swaths of their pension pot, or possibly the lot.

-

Opinion

OpinionEditorial: Pensions fortune-telling

A hot topic of conversation last week was Channel 4’s Dispatches programme on the impact of the imminent pension freedoms, as the government launched its Pension Wise guidance service.

-

News

How DC savers feel about their retirement options

Most over-55s would prefer a secure guaranteed income for life over all other retirement options, a survey has found, prompting calls for the government’s guidance guarantee to cater to this preference.