More LGPS news – Page 17

-

Opinion

OpinionA once-in-a-lifetime opportunity to transform local authority pensions

The outlines are now becoming clear of what is probably the biggest shake-up in local authority pensions since their launch before the second world war.

-

Opinion

OpinionStriking a balance amid rising longevity

Talking Head: The Lancashire and London Pensions Partnership’s Michael O’Higgins says in the face of increasing liabilities, it is even more important to get the balance right between security and returns.

-

Opinion

OpinionSpeed dating for LGPS funds: How to choose your pooling partner

The government-imposed asset pooling of Local Government Pension Scheme funds forces committees to ask themselves on what basis they will choose pooling partners. Mercer’s Jo Holden gives tips on what schemes should focus on.

-

News

Just over half of LGPS have procedures for legal breaches

A little over half of public sector pension schemes have procedures set up to handle breaches of law, but experts have said scheme governance is improving markedly among local government pension schemes.

-

Opinion

OpinionAn outstanding year for pensions…

Editorial: And by that I mean we’re coming to the end of 2015 with several gargantuan issues left outstanding, hanging over the heads of schemes and providers.

-

News

NESPF saves 108 days with new payroll software

North East Scotland Pension Fund has made “huge savings” in administration costs and time through its new payroll software, allowing it to focus on the changing structure of the Scottish Local Government Pension Scheme.

-

News

Autumn Statement could blow icy winds for LGPS

An anticipated hit to local authority funding in the government's Autumn Statement next month is threatening to ratchet up pressure on the Local Government Pension Scheme.

-

Features

FeaturesThe Specialist: Investment trends – October 12 2015

How are schemes responding to the latest twists in the investment landscape, including interest rate speculation and global market wobbles? Download The Specialist here to find out how your scheme can raise its defences while gaining returns.

-

News

NewsOsborne's wealth funds target LGPS cost savings to boost infra

Chancellor George Osborne pushed local authority scheme collaboration forward this week by declaring they would be pooled into six 'British Wealth Funds' as part of a plan to ramp up infrastructure investment and reduce scheme running costs.

-

News

Welsh funds reach impasse on asset-pooling plans

Welsh local authority pension funds have made progress on mapping the road towards pooling their assets, but along with their peers are awaiting further details on the criteria around governance, size and cost.

-

News

NewsAsset insourcing saves LPFA 75% on fees

FT Investment Management Summit: The London Pensions Fund Authority could run as much as half of its assets in-house within the next three years, cutting the fees charged on those assets by three-quarters.

-

News

Defying criticism: The other burden of being a lay trustee

Any Other Business: Lawyers, actuaries, professional trustees. The world of pensions is so full of highly specialised roles it can seem bizarre so much of the decision-making comes down to elected trustees who may have no experience with pensions.

-

Opinion

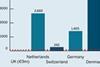

OpinionScheme fragmentation more stark in private sector than public

Data Crunch: The appointment last month of Edi Truell as the London Mayor’s new adviser on pensions and investments is part of an initiative, we are told, to amalgamate some of the country’s numerous public sector pension funds and aims to save billions of pounds through greater efficiencies, lower fees and improved returns.

-

News

Charity puts centre up for sale to cover LGPS costs

The Multiple Sclerosis Society is to sell a support centre to meet the cost of its local government pension scheme membership, the latest charity to sell assets to cover defined benefit costs.

-

Opinion

Global infrastructure investment for smaller pension funds

Infrastructure investment has been the preserve of larger funds, but the LPFA’s Susan Martin says more collaboration will open up the market.

-

News

LGPS sharpens focus on collaboration as consultation looms

News analysis: Local authority schemes are poised for the outcome of a consultation on collaboration which could compel them to pool their investment assets to save on costs.

-

News

Falkirk targets social housing with £30m investment

Falkirk Council Pension Fund is joining the ranks of local authorities investing in social housing, with a £30m allocation, as experts debate the strengths of the asset class.

-

Opinion

LPFA: Now is the time to remove barriers to collaboration

LPFA chief Susan Martin explains why it is crucial to better enable collaboration across schemes.

-

News

Regulator fleshes out compliance approach to public sector

The Pensions Regulator has released details of its compliance and enforcement policy for public service schemes, after taking on oversight of more than 200 plans from April.

-

News

Havering struggles to find local infra for growth

The £506m London Borough of Havering Pension Fund is looking to invest in local infrastructure projects, but the need to balance this with strong returns is hampering its search.