More Law & Regulation – Page 127

-

News

Isa set-up fails to win over pensions crowd

The industry has broadly rejected a wholesale shift of the current pension tax system towards an Isa-style approach, but some have woven together several ideas in an attempt to better incentivise saving.

-

News

Welsh funds reach impasse on asset-pooling plans

Welsh local authority pension funds have made progress on mapping the road towards pooling their assets, but along with their peers are awaiting further details on the criteria around governance, size and cost.

-

News

Pension dashboard could 'fail in its objective'

Pension dashboards enabling savers to view their retirement assets in one place are set to become a reality, but commentators have questioned how they will be funded and some fear they could do “more harm than good”.

-

News

NewsFreedom variability distorts member behaviour, FCA study shows

Data from the Financial Conduct Authority has shown drastic changes in how consumers access their pensions since the introduction of the flexibilities, though experts have said difficulty accessing some options may have skewed consumer choices.

-

News

NewsGranada appeal threatens contingent asset arrangements

Broadcaster Granada is appealing a High Court ruling in an attempt to recover £40m of gilts from one of its pension schemes, but lawyers say the case could jeopardise other employers’ non-cash contributions.

-

News

VAT burden shows little sign of abating as key deadline approaches

News Analysis: Employers need a better way of reclaiming VAT on behalf of their schemes than that set out by HM Revenue & Customs, lawyers say, as a December deadline for schemes to renegotiate service contracts looms.

-

News

BBC to lay on financial advice for members looking at transfers

The BBC is to offer paid-for independent financial advice to help members get the most from the pension freedoms, in particular to support those considering transferring their assets.

-

News

Regulator releases further covenant guidance

The Pensions Regulator has issued new guidance on assessing employer covenants aimed at preventing smaller or highly funded schemes from wasting time and money on costly advice.

-

News

NewsIORP amendment threatens pot-follows-member

A draft report from the European Parliament committee on economic and monetary affairs has threatened the possibility of pot-follows-member legislation being introduced, lawyers have warned.

-

News

Out of reach: How can we close the trustee skills gap?

Any Other Business: If you’re reading this as a trustee and wondering why so many questions are being asked about the future of the role, chances are you’re among the fraction receiving ongoing formal training.

-

News

High-earner tax relief threat poses new challenge for employers

News analysis: Scrapping tax breaks for high earners could present a communication challenge for trustees, as the government weighs up ideas for potentially radical reforms of the current pension tax relief system.

-

News

NewsFCA pays out £200,000 after benefit error

The Financial Conduct Authority has paid £200,000 to members of its own staff scheme after discovering benefit calculation errors affecting more than 1,200 employees.

-

News

EU banking directive brings risks to schemes' derivative contracts

Schemes with liability-driven investment strategies should review counterparty creditworthiness, say lawyers, as a new EU directive has granted national authorities the power to suspend schemes’ contractual rights with struggling banks.

-

News

NewsIndustry left reeling by latest pension tax proposals

Summer Budget: Chancellor George Osborne today unveiled a green paper proposing a significant overhaul of the current pensions tax relief system, going beyond what the industry had expected and acting as a harbinger of further radical reform.

-

News

NewsFindel forks out £2.3m to repair equalisation error

Findel Group Pension Scheme has paid more than £2.3m in past-service costs to make good an error in which a member benefit equalisation exercise was implemented incorrectly.

-

News

NewsTUC calls for same-sex parity on survivor pensions

One in four defined benefit schemes do not treat same-sex and opposite-sex couples equally on survivor benefits and the TUC is pressing government to close the gap, which could cost around £3.3bn.

-

News

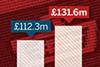

New peak for pension saving, focus turns to adequacy

Data analysis: Scheme membership has reached fresh highs among the UK population but industry experts are calling for greater government intervention to boost contributions and to stop individuals falling through the cracks.

-

News

Is your scheme safe from latent liabilities?

Any Other Business: In February 2002, the US secretary of defence Donald Rumsfeld gave his now-famous response to a question about the lack of evidence linking the Iraqi government to the supply of weapons of mass destruction.

-

News

Employers await further guidance on scheme VAT rules

Employers will be hoping to benefit from VAT rebates on scheme services following HM Revenue and Customs’ latest guidance note, but pension lawyers have said further detail is needed on how to recover the tax.

-

News

NewsIndustry poised for pensions surprises in emergency Budget

Analysis: Industry experts anticipate further changes to pensions in the emergency Budget and have expressed concerns over the longer-term impact on the UK’s retirement savings culture.