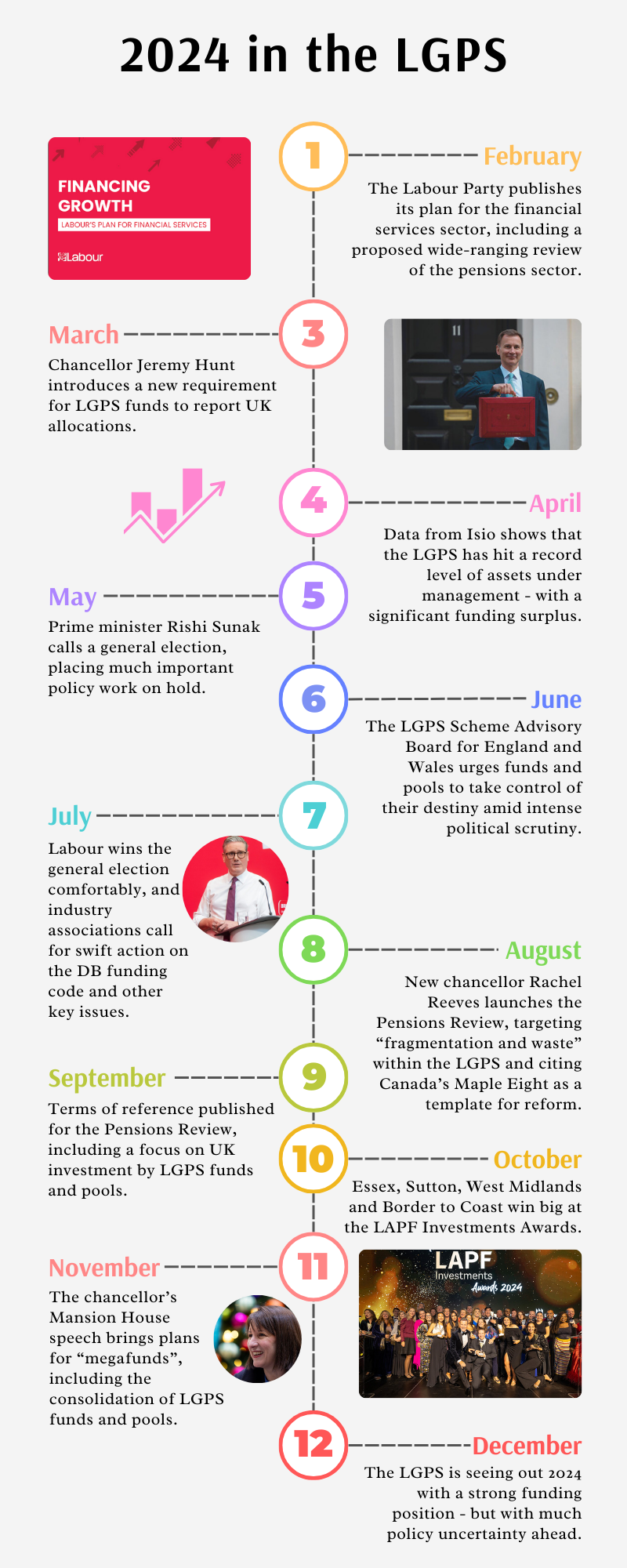

Change is afoot for the Local Government Pension Scheme, with consolidation plans from government and demand for more UK-focused investment. What will the next year bring?

With the UK government intent on introducing sweeping reforms to Local Government Pension Scheme (LGPS) funds, next year could prove seismic for local authorities.

Since Rachel Reeves’ arrival as chancellor in July, pension schemes have been put on notice over their approaches to investment and governance.

The LGPS is seen by the government as a source of untapped investment potential into UK assets. Reeves has visited Canada to consult with leaders of its so-called ‘Maple Eight’ pension funds, these giant public sector pension funds being viewed as an example of how greater scale can facilitate more impactful investment.

Reeves has hit out at apparent “fragmentation and waste” within the LGPS, in comments that have not gone down well with some experts.

“The wording is inflammatory and founded on the assumption that bigger is better,” Cartwright senior adviser Ian McKnight tells Pensions Expert.

Aon associate partner Laura Caudwell believes that the comments “do not acknowledge the hard work and significant successes that have been made by the LGPS in recent years”.

Reeves used her Mansion House speech in November to set out the government’s plans for LGPS consolidation as part of its growth agenda.

The government’s “Fit for the future” consultation, which closes on 16 January 2025, lists 18 proposals for LGPS pooling, investment and governance.

Fit for the future

Trevor Castledine, chief commercial officer at LGPS Central, believes that this consultation, which indicates “significant governance and pooling changes”, represents the biggest issue facing the LGPS over the coming year.

“There may also be knock-on effects of how structural changes to local government such as devolution might indirectly impact the LGPS,” he says.

“Beyond this are a series of ongoing issues that are impacting the entire pensions landscape like challenges in administration, rolling out pension dashboards and the changing geo-political landscape.”

Unless “meaningful progress is seen towards whatever goal is intended”, Cartwright’s McKnight expects “a heavier-handed approach from government which likely just wants one pool and to move liabilities off balance sheet and that pool to become a sovereign wealth fund providing capital for the backing of government initiatives of the day”.

More mergers ahead?

While experts anticipate more LGPS pooling, they are divided over whether there will be an increase in scheme mergers. McKnight thinks that there will “almost certainly” be more mergers, but Aon’s Caudwell is less sure.

“We don’t think mergers appear to be a requirement of the new proposals,” she says.

“In the short term, we expect that merging funds at the same time as trying to meet the pooling requirements is going to be less likely, but after April 2026 we may see more voluntary mergers.

“Given there are over 18,000 employers in the LGPS and the complex nature of the benefits, merging funds is going to be a time-consuming and costly thing to do, and so while it may deliver some adviser fee savings in the long term, it doesn’t feel like a priority at present.”

Employers seek reduced contributions

The coming year represents another valuation point for the LGPS, which flipped into surplus at its last triennial valuation in 2022, with a funding level of 107%.

“We’re expecting the scheme as a whole to be very much in surplus,” says Jeremy Hughes, deputy secretary of the LGPS Advisory Board. “It’s been a hard slog since the general financial crash of 2008 to get back to this position.”

At the end of the third quarter, the LGPS in England and Wales had an estimated surplus of £44bn according to Isio, based on its Low-Risk Funding Index.

“It does raise questions about setting of employer contribution rates,” Hughes continues, who observes that employers are beginning to enquire about “significant reductions to their contributions”.