Data crunch: Absolute return and flexible fixed income strategies have been hugely popular with UK pension schemes in recent years, for a variety of reasons.

While some schemes turn to these strategies to preserve capital, others see them as a means of generating income or boosting total returns.

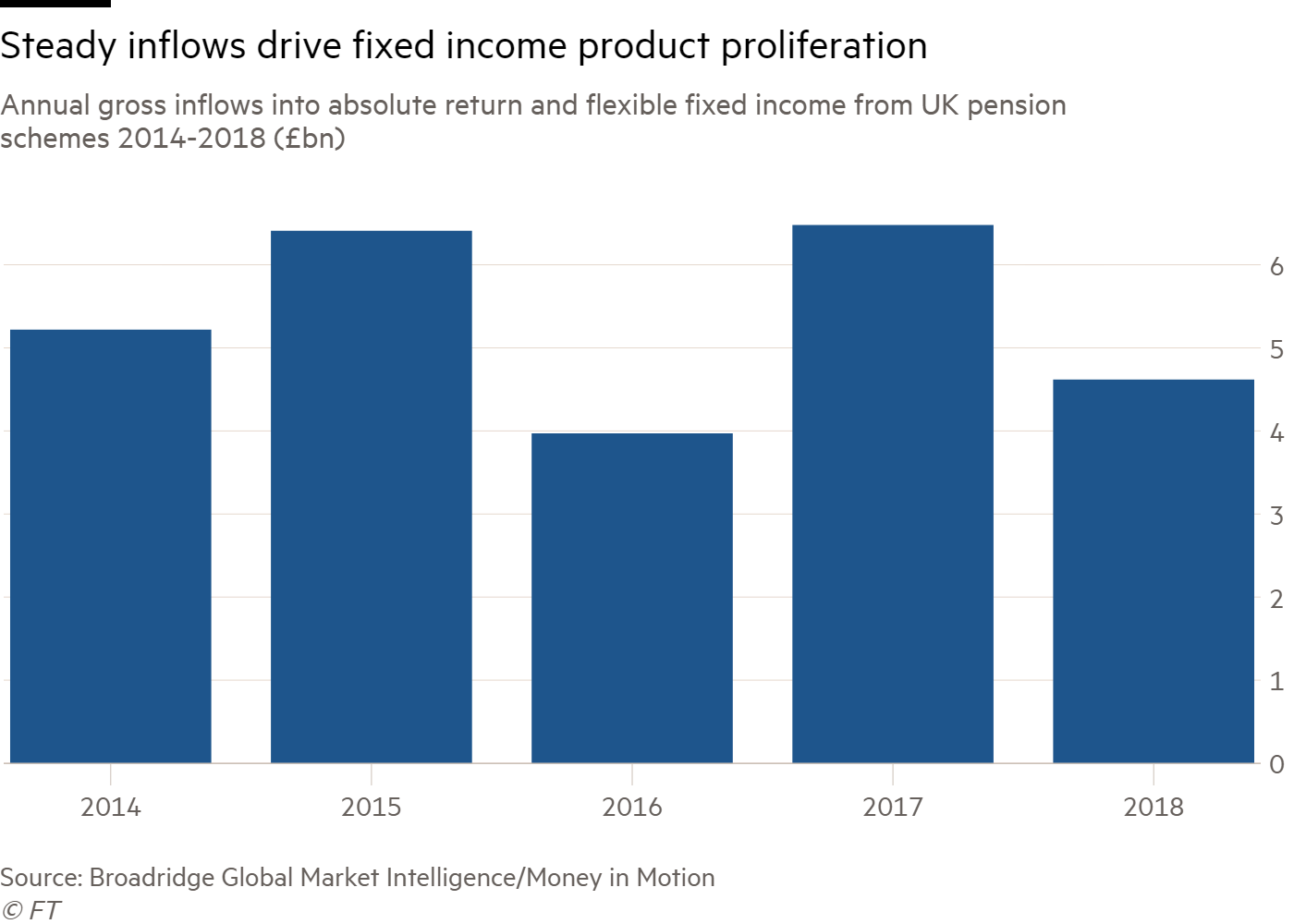

Asset managers have responded to this interest by selling a diverse range of products, that in aggregate have recorded total gross sales of £27bn over the past five years.

Schemes should take care to examine underlying fund characteristics (and not just the marketing materials) to make sure that the strategy is most appropriate to the scheme’s objectives and constraints

The confluence of demand from UK schemes and competition among asset managers to launch differentiated strategies has resulted in the emergence of an expansive ecosystem of products that is difficult to characterise.

A puzzling array of fund types

At a very broad level, this universe can be segmented into three families, where strategies differ according to their return objective, the range of underlying fixed income instruments employed, and even the manner in which they are marketed to different target audiences.

In one corner of the universe sits multi-asset credit. These strategies typically represent a growth-focused allocation, often serving as an equity or multi-asset replacement for defined benefit schemes.

The funds generally aim to deliver strong total returns significantly higher than a reference rate such as the London interbank offered rate by rotating exposures across a range of investment-grade and high-yield credit assets.

What are often termed absolute return fixed income strategies can be found at the other end of the spectrum. These funds focus more on manager skill in protecting the portfolio from downside risk and generating a positive return in all market environments.

DB schemes in particular have been attracted to the promise of downside protection and also because their return profile complements liability-driven investment strategies. Defined contribution schemes have also increasingly been using absolute return bond funds as components in the latter stages of their investment glide paths.

The third family is diversified fixed income. These approaches typically invest flexibly across different fixed income instruments, and have found success among smaller schemes and retail investors. Many of these strategies are focused more on providing income rather than targeting absolute or total return.

Check funds’ underlying characteristics

The lines between these three categories have been blurred by the existence of strategies that exhibit characteristics that could be attributed to each of the different families.

One prominent fund that sits within this universe is marketed as multi-asset credit, but allocates to government bonds as well as credit assets – similar to a diversified fixed income strategy – and mentions an explicit objective to preserve capital – akin to an absolute return fixed income fund. This strategy can therefore, confusingly, be bucketed into any of the three categories described above.

It is likely that interest in these strategies will persist and that asset managers will continue to bring new products to market to meet demand.

While innovation is certainly welcomed, schemes should take care to examine underlying fund characteristics – and not just the marketing materials – to make sure that the strategy is most appropriate to the scheme’s objectives and constraints.

Jonathan Libre is a principal in the EMEA Insights team at Broadridge Financial Solutions.

Interested in LGPS? Register now to attend the Pensions Expert Local Government Pension Scheme Forum on September 12 2019 live.ft.com/LGPS