All Drawdown articles – Page 5

-

Opinion

OpinionWhat have we learnt from the FCA’s Retirement Outcomes Review?

The Financial Conduct Authority’s final findings from its Retirement Outcomes Review offer a fascinating early glimpse into the behaviours of consumers after the introduction of pension freedoms, says Redington’s Jon Parker.

-

Features

Should the FCA set a drawdown charge cap?

The Financial Conduct Authority’s final report for its Retirement Outcomes Review focused on the challenges facing drawdown consumers.

-

Opinion

OpinionSidecars suit self-employed

Editorial: Self-employment is more common than ever, and the distinct lack of any concrete solution to get these people saving for retirement is becoming increasingly worrying.

-

News

NewsFCA recommends investment pathways for drawdown

The Financial Conduct Authority has proposed that pension providers are required to develop three ready-made investment pathways to help confused drawdown customers, but has shied away from imposing a charge cap on the products.

-

News

Government rejects calls for default decumulation pathways

The government has rejected the Work and Pensions Committee’s recommendation for default decumulation pathways, but has agreed that there is a strong case for pensions dashboard compulsion.

-

Opinion

OpinionDefault pathways strengthen freedom and choice, not weaken it

Members should always be encouraged to make an active choice about their retirement income, but we know not everyone will. Government should therefore provide clear principles to govern the creation of good-value defaults, says the Pension and Lifetime Savings Association’s Nigel Peaple.

-

Opinion

DC Debate Q2: Deferred annuities, retirement expectations and more

Five defined contribution experts talk about deferred annuity products, retirement expectations, and how the industry is adapting to people’s changing work patterns.

-

Opinion

OpinionMistakes of annuity regime are being repeated

From the blog: The willingness of government and regulators to take a pragmatic approach to so-called pensions freedom will be tested over the next few weeks.

-

News

Smart Pension and L&G to develop first default retirement pathway

Default retirement pathways could become a feature of the UK pensions system as early as next year, as Smart Pension and Legal & General announce plans to develop a product combining drawdown and annuities.

-

News

Third of retirees in drawdown have no investment experience

Thirty-two per cent of people in drawdown do not have any investment experience, yet two in five of them have not received advice or guidance, according to a recent report that urges the introduction of drawdown MOTs.

-

Opinion

OpinionInaction on retirement defaults puts members at risk

From the blog: When discussing retirement pathways, the industry needs to ask itself two key questions: what is the goal of auto-enrolment, and what does success look like?

-

Features

Has the industry kept its promise on at-retirement innovation?

Analysis: When the Department for Work and Pensions allowed the industry to block mastertrust Nest from entering the drawdown market in 2017, it did so with a proviso; the industry had to drive innovation itself.

-

News

UK could profit from Australia’s missed default opportunity

A default drawdown proposition rejected by the Australian government could offer “freedom from the pension freedoms” for unengaged savers who cannot afford advice at retirement, it has been claimed.

-

Features

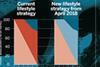

Pearson follows pack in targeting drawdown for DC defaults

The Pearson Pension Plan is introducing two new lifestyle options for its defined contribution members as they approach retirement, responding to a perceived demand for greater flexibility.

-

News

Default drawdown tops select committee's at-retirement wishlist

Providers of drawdown products should be required to develop charge-capped default products to help disengaged savers make their pension last, the Work and Pensions Committee has recommended.

-

Features

FeaturesJLR drives down costs with DC strategy refresh

UK automotive stalwart Jaguar Land Rover has embarked on a complete overhaul of its defined contribution offering in a bid to drive down costs and improve member outcomes.

-

Opinion

OpinionPension freedoms need added support for savers

We all enjoy having control over our financial future, writes Nest’s Gavin Perera-Betts, but introducing default retirement pathways could be the surprise present we need most this year.

-

Opinion

OpinionAn age-old problem

Editorial: There is currently an advert on some trains that promotes a privacy filter for computer screens. Unfortunately such devices are yet to be invented for phones.

-

News

NewsGina Miller: Brexit could change retirement attitudes

Economic turmoil induced by the UK’s exit from the EU might tempt savers to draw from their retirement pots sooner, according to Gina Miller, founding partner at wealth manager SCM Direct.

-

Opinion

OpinionIt's time to put our faith in experts

From the blog: The transfer market has been frantic with activity since the introduction of pension freedoms in 2015. Around £50bn has been cashed out of company pension schemes over the past two years, according to Mercer.