Defined benefit (DB) pension schemes ended the first quarter of 2025 with an aggregate funding surplus of more than £200bn, according to the Pension Protection Fund (PPF).

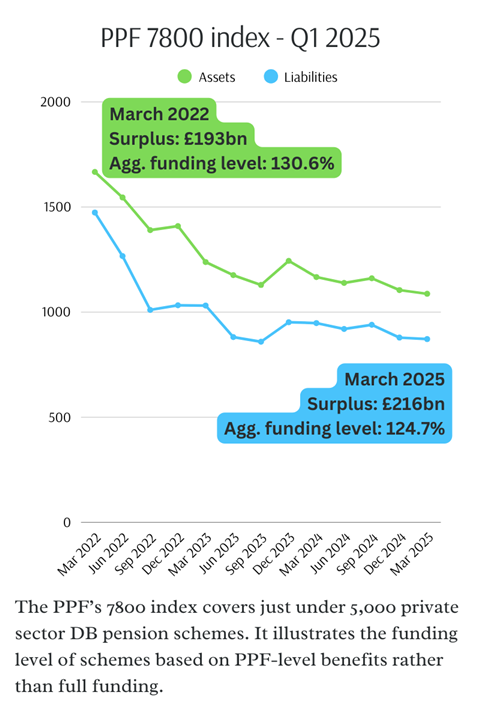

The latest update to the PPF 7800 Index of private sector DB pension schemes showed an aggregate funding level of 124.7% at the end of March 2025, on a section 179 basis.

This equated to an aggregate funding surplus of £215.5bn – although this was down from £232.7bn at the end of February.

Total assets across the universe of 4,969 DB schemes fell to £1,087.2bn, down from £1,124.1bn a month earlier. Liabilities also fell to £871.7bn, from £891.4bn at the end of February.

The first week of April has seen global equity markets tumble following the introduction of trade tariffs by the Trump administration in the US. This followed volatility in UK gilts in January amid concerns about a weak economic growth outlook.

Sarah Elwine, actuarial director at Broadstone, said these movements were “likely to have impacted funding levels, and the time horizon of this turbulence also remains uncertain depending on negotiations and retaliations”.

“This volatility emphasises the benefits of a matching investment strategy for schemes,” Elwine added.

“While we wouldn’t expect that trustees would need to take any immediate actions, they may want to consider in due course whether employer covenant for their schemes has been affected by the introduction of tariffs, particularly given the increase in employer national insurance and minimum wage changes also coming into effect this month.”

‘Comfortable surplus’ remains – for now

Shalin Bhagwan, the PPF’s chief actuary, said bond yields were influenced more recently by Germany’s decision to relax its “debt brake” and pass other fiscal easing measures. Higher gilt sales announced in the Spring Statement also affected government bond prices, he added.

Vishal Makkar, managing director of UK wealth consulting at Gallagher, said that, while the overall aggregate funding level had dipped, “the fact remains that DB schemes are largely performing well in the UK, with many sitting in a comfortable surplus”.

“In the current macroeconomic climate, trustees must take advantage of all their options,” Makkar added, warning that there were several “unknown variables” ahead, including the Pensions Scheme Bill.

“There are many reforms in the pipeline, and so it is paramount that trustees keep open lines of communication with sponsors and members until the government’s plans are formally set in stone,” he said.

The number of pension schemes in deficit jumped to 1,408 at the end of March, equivalent to 28% of schemes in the PPF 7800 Index. This compared to 1,278 in deficit a month earlier (26%).

Pension schemes that are in surplus on a section 179 basis are deemed to have enough assets to secure benefits at least in line with PPF compensation.