In his latest article exploring the development of pensions dashboards, Richard Smith dusts off a couple of old pensions to find out how they will be displayed on dashboards, complete with the benefits of compound interest.

Welcome to 2025: the year of live data connections to the dashboards ecosystem. It’s so exciting!

As we look forward to a bright dashboards future, I’m looking back in this series of articles at each of my own nine pensions, to illuminate dashboards challenges, both for schemes and for consumers.

We’ve now arrived back in the heady 1990s. Tony Blair is leader of Her Majesty’s Opposition, Oasis’s Wonderwall is in the charts, and Four Weddings and a Funeral is making a superstar of Hugh Grant.

For me, this is also a poignant article, from a key time in my life. Episode #4 mentioned I’m a spouse pensioner, and this article tells that story. If you’re feeling a bit January bluesy, maybe don’t read on?

The Prudential Staff Pension Scheme (PSPS)

Like many school and college leavers in the Reading area in the 1980s and 1990s, I was working at Prudential. I say working, but, when you’re in your 20s, a workplace is about so much more than just work, isn’t it?

As well as being the place I gained lots of useful experience in pensions technology and administration, the ‘Pru’ was also where I met my lovely wife Heather Wood. In fact, it’s exactly 30 years ago last week since we got together, on New Year’s Day 1995.

In my head, I break down the 30 years since then into three roughly equal thirds:

- 1995 to 2004: Heather and I got married and were blessed with three children.

- 2004 to 2014: Heather was diagnosed with breast cancer and had chemotherapy for a decade.

- 2014 to 2025: Heather died, meaning I’ve been receiving a PSPS spouse’s pension for over 10 years.

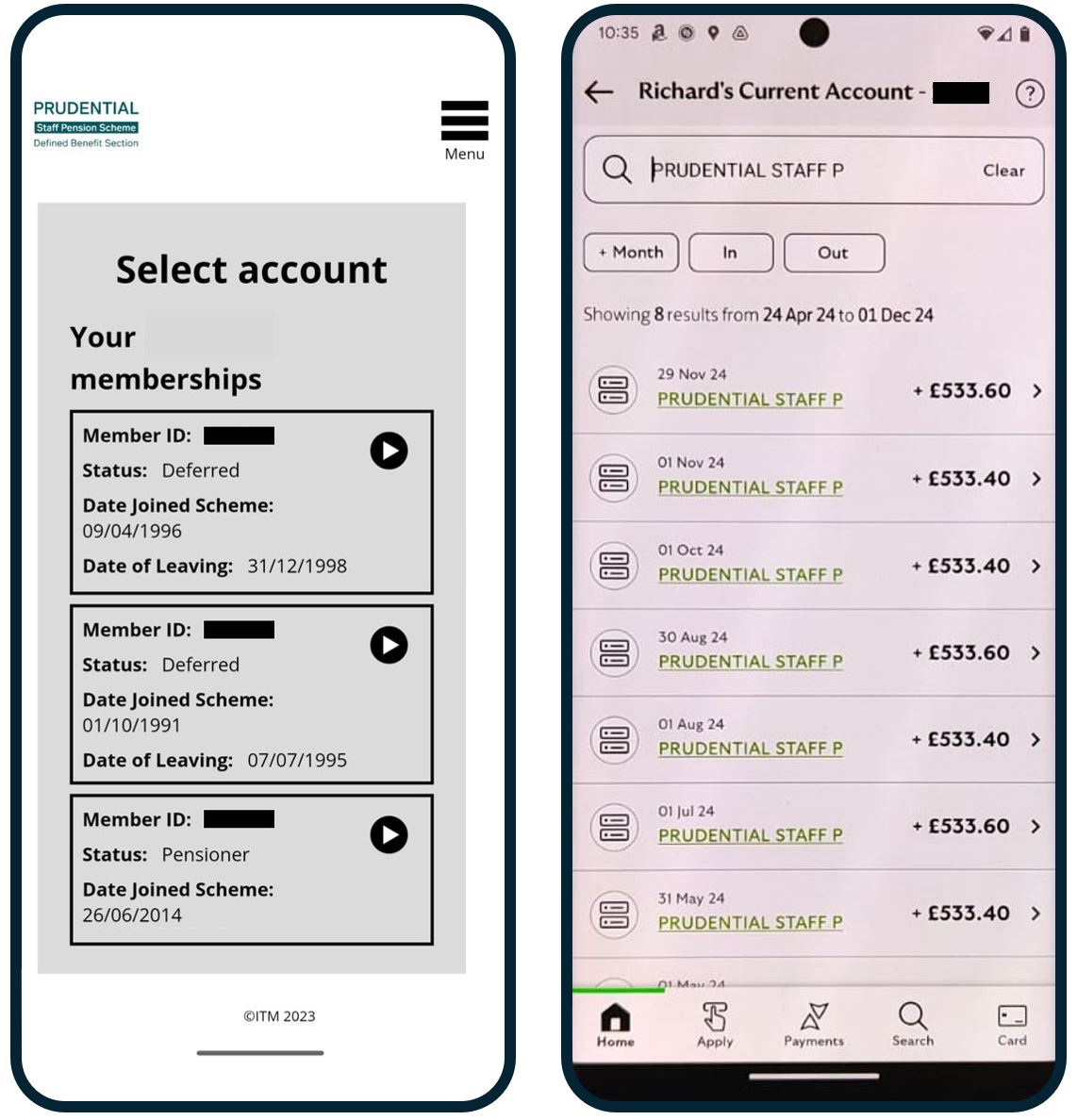

At the bottom of the lefthand screenshot below, the PSPS website shows me that I have been a (spouse) pensioner member of the PSPS Defined Benefit (DB) Section since 26 June 2014, which was the day after Heather died.

Pensions in payment excluded from dashboards… for now

Of course, when I access a pensions dashboard, I won’t see my PSPS spouse’s pension displayed as schemes and providers are only required to return data in respect of active and deferred pensions.

People often ask me: “Richard, why aren’t pensions in payment going to be shown on dashboards?”

My primary answer is: “People don’t need to ‘find’ their pensions in payment because they already see the regular pension income money coming into their current account each month, just like a salary.”

For me, my banking app receipts (shown above on the right) are a monthly reminder of how very lucky I was to meet and marry Heather, and will be until the day I die. Because pensions span the whole of your life, they’re not just about money: they’re about memories, and love, and loss. Pensions are emotional. From experience, I can say: pensions in payment, and the lovely times they represent, are never lost.

Looking forward, post-launch of dashboards, if there’s strong demand from consumers during the 2030s to be able to see crystallised pensions on dashboards, then maybe the Department for Work and Pensions will expand the regulatory set of data that schemes must return to also include pensions in payment.

Personally, though, I think that’s unlikely, as Open Banking-enabled commercial pensions dashboards, which connect to your current account, can already show your pension payments received alongside exported data for your other pensions not yet in payment. Dashboards really rock!

Pensions 6 and 7: My two deferred PSPS pensions

Also on the PSPS screenshot above, you can see I have two deferred pensions. Why? After Heather and I got together as a couple, we thought it would be best for me to move teams, but that wasn’t possible, so I left Prudential entirely. I then rejoined the Pru in another team the following year.

My two deferred DB pensions relate to my two Prudential employments respectively: 1996-1998 (post-Heather) and 1991-1995 (pre-Heather). I really love how pensions become a fossil record of your life!

“Our research shows most consumers are likely to understand this best on a dashboard if multiple records are kept separate, rather than the potential confusion of merging records or returning combined results.”

James Peel, XPS

It’s quite common for people to have multiple memberships within one scheme, or, in my case, within one section of a scheme. XPS Group is the administrator of the DB section of the PSPS, and has chosen PensionFusion from Equisoft/Lumera as its integrated service provider, or ISP.

I asked XPS client services director James Peel how XPS intends to return my two pensions to a dashboard.

He explained: “Our admin system holds two deferred records for you, Richard. XPS has considered how best to handle this situation from a consumer perspective. Our research shows most consumers are likely to understand this best on a dashboard if multiple records are kept separate, rather than the potential confusion of merging records or returning combined results.

“So there will be two record matches to be made for you, and two responses to a Find Request. Then we’ll expect to subsequently receive two separate View Requests from a dashboard: one View Request for your first deferred pension, the other View Request for your second deferred pension.”

It’s good to hear that XPS and PensionFusion have thought through such complexities. It was announced in December that PensionFusion and Heywood were the first two volunteer participant data providers to have successfully completed integration testing with the Pensions Dashboards Programme’s (PDP) Central Digital Architecture.

These two providers gave verbal updates on their work at a PDP ‘Town Hall’ event in early December so that other data providers could benefit from their experience.

DB revaluation is really important

Tapping on each of my deferred memberships today brings up my two sets of ‘Deferment Details’.

Just like my Centrica pension in Episode #5, my deferred PSPS figures shown are very out of date. On the left, the figure is as of December 1998, i.e. just over 26 years out of date, while on the right is as of July 1995, meaning it is now nearly 30 years out of date.

(Notice, by the way, that the XPS website today doesn’t say this is an annual income – does it assume I know this?)

Of course, when XPS responds to my two View Requests, it must return deferred pension income amounts which have been revalued to date. Luckily, XPS already does this calculation every quarter.

“We are currently exploring the option of returning the relevant revalued deferred DB figures from this existing routine… It’s a good example of the scheme-specific, pre-connection work we’re doing for dashboards.”

James Peel, XPS

Peel said: “For PSPS, we already carry out quarterly transfer value calculations for all deferred DB members, and store the results. For dashboards, we are currently exploring the option of returning the relevant revalued deferred DB figures from this existing routine.

“We also have the option of using our universal calculation tool, which we’re deploying for many of our client schemes. We’ll settle the final approach with the PSPS trustees well ahead of their staging date. It’s a good example of the scheme-specific, pre-connection work we’re doing for dashboards.”

My two revalued deferred DB pensions

I know it’s just the power of compound interest, but I still find it amazing how much the revaluation calculations have increased my two deferred PSPS pensions over 26 and 30 years respectively.

|

Employment period |

PSPS pension at date of leaving |

PSPS pension revalued to 2024 |

Percentage increase |

|

1996-98 |

£1,028 a year |

£1,920 a year |

c.90% |

|

1991-95 |

£1,131 a year |

£2,256 a year |

c.100% |

It’s so important for consumers to be able to see revalued deferred DB pensions on dashboards – it really is worth all the effort pension schemes and administrators are currently making to achieve this for members.

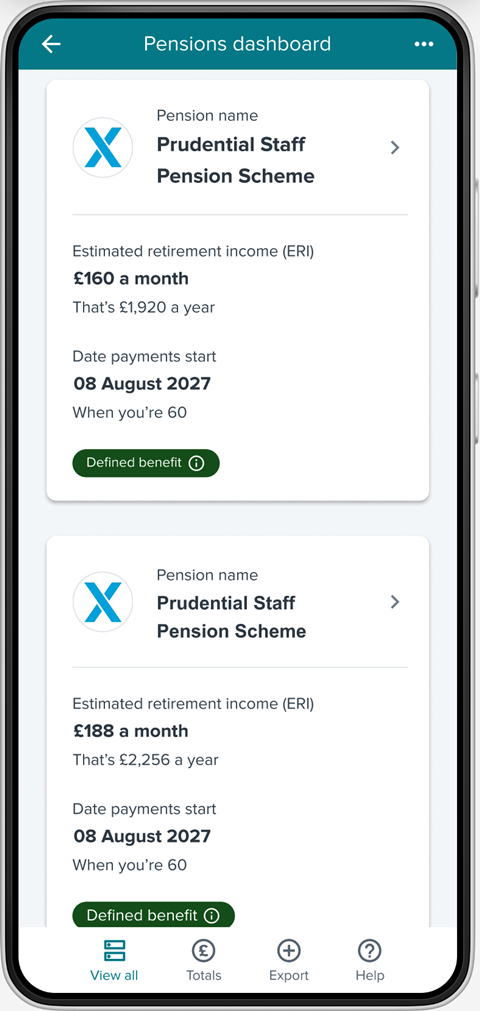

If I viewed my two deferred PSPS pensions on a dashboard, they might appear like the mocked up Summary List screen below, in this example showing the estimated retirement incomes revalued up to 2024.

As you can see, my normal retirement date in the PSPS is when I’m 60 in 2027. We need to get dashboards launched before then so I can actually see these pensions on a dashboard before I retire!

Connecting my PSPS pensions to the ecosystem

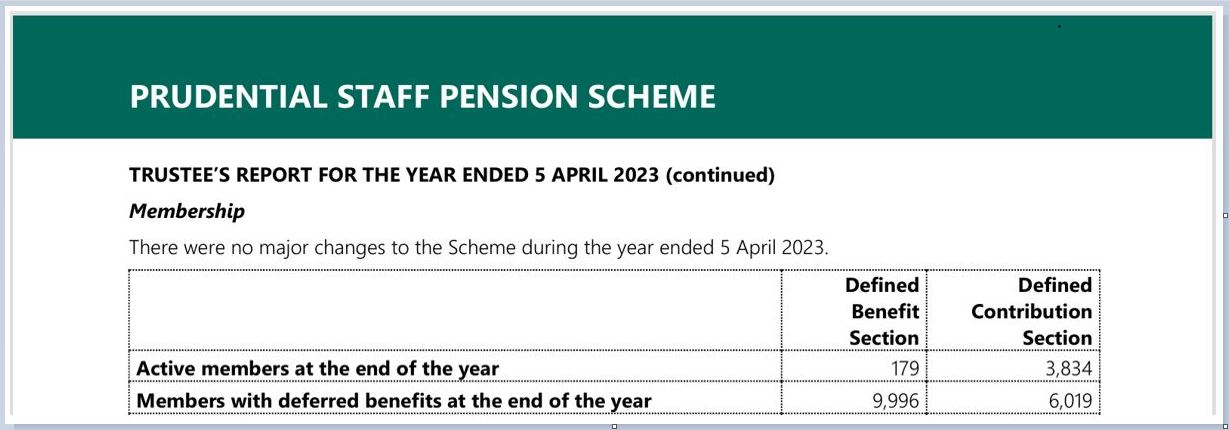

Below is the membership section from the Prudential Staff Pension Scheme’s annual report for the year ended 5 April 2023.

Across the pension scheme’s DB and defined contribution sections there were just over 4,000 active members and just over 16,000 deferred members, making just over 20,000 non-pensioner members in total.

Across the pension scheme’s DB and defined contribution sections there were just over 4,000 active members and just over 16,000 deferred members, making just over 20,000 non-pensioner members in total.

This means the scheme’s staging date for connecting to thedashboardsecosystem is 31 May 2025. (Had it been just below 20,000, the staging date would have been a month later: 30 June 2025.)

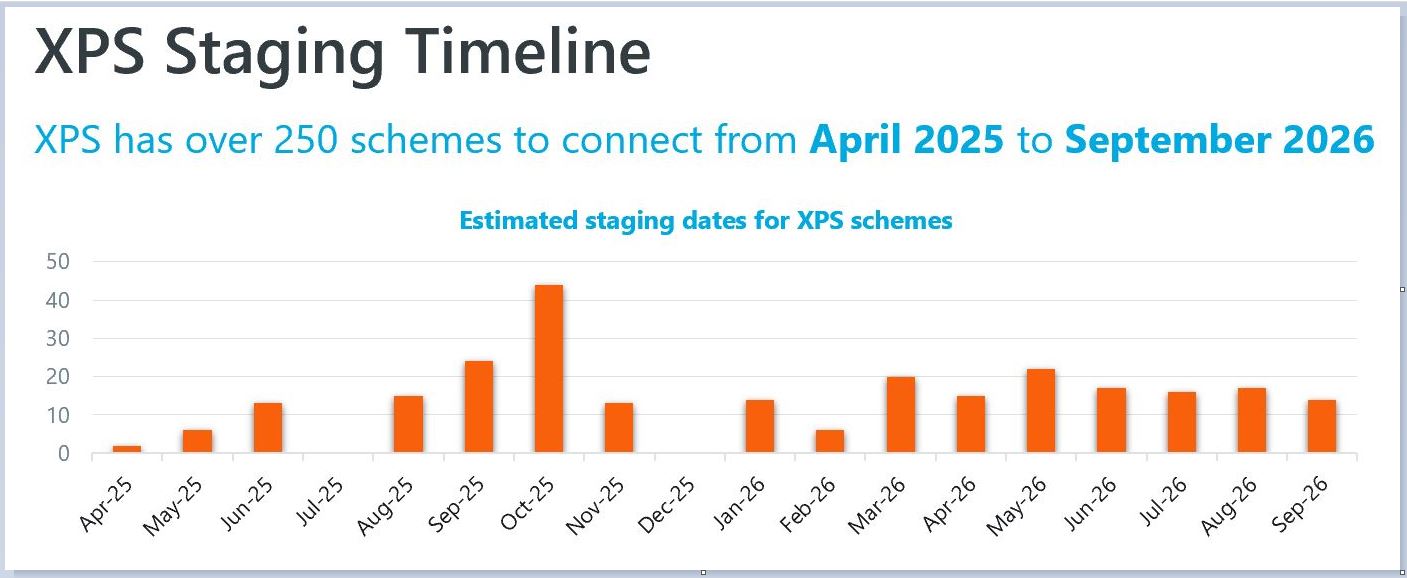

From the graph below, we can see therefore that the PSPS falls in the first 10 or so schemes that XPS must connect to the dashboards ecosystem out of the over 250 schemes it administers.

MoneyHelper dashboard testing and lessons

The MoneyHelper dashboard team at the Money and Pensions Service (MaPS) confirmed at the Town Hall event that, from this spring onwards, it plans to invite consumers to test its dashboard.

From 1 June, if these invitees include any consumers who happen to be active or deferred members of the PSPS, then they should see their PSPS pensions displayed on the MoneyHelper dashboard.

This testing with real users will start to illuminate what real consumers think, feel, and do after they have seen their pensions together on a dashboard.

For XPS, and all administrators, one of the big unknowns is how many users of different types will ‘click through’ from a dashboard to the scheme’s website, and with what types of enquiries. Live user testing from this spring onwards will illuminate all of this.

Are we nearly there yet?

Yes, we are!

There’s just my first ever workplace pension from the 1980s (Episode 7), and my state pension (Episode 8), to go.

Then, in Episode 9, we will be able to bring everything together to show the thing I (and most consumers) really want to understand: what my total estimated retirement income might be.

Or will we? My first workplace pension scheme is now in the Pension Protection Fund (PPF). Will PPF compensation income figures be shown on dashboards? Come back next month and find out!

Richard Smith is an independent pensions dashboards consultant.

Dashboards Nine-Nine: How Nest is preparing for connection day

With nine months to go to the first dashboards connection deadline, independent pensions dashboards consultant Richard Smith presents the first in a series of profiles exploring how firms are preparing.

- 1

- 2

- 3

- 4

- 5

Currently

reading

Currently

reading

Dashboards, deferred pensions, and revaluations - bringing it all together

- 7

- 8

- 9