Independent pensions dashboards consultant Richard Smith continues his series of monthly case studies looking at how providers are preparing for the connection deadlines.

You made it to Episode 4 – you must love dashboards too!

For any newcomers to the Dashboards Nine-Nine ‘club’, this is a series of nine monthly case study articles exploring how each of my own pension schemes and providers are getting ready for dashboards. These nine providers are a rough proxy for the industry as a whole.

Each pension also illustrates a different consumer understanding challenge.

For this article, I will be investigating defined contribution income.

Pension 4: Aon Master Trust

Back at the turn of the millennium I was at Aon, and a defined contribution (DC) member of the Aon Retirement Plan – a single employer DC trust.

This pension is now a section of the much bigger Aon Master Trust. Such consolidation is another example of changing pension names, as we explored in Episode 3.

The Aon Master Trust’s administration is sub-contracted to Aegon and, with six months to go until connecting to the dashboards ecosystem, the trustees are making good progress with the administrator to get ready.

Aon’s preparations

Tony Pugh, DC solution leader at Aon, confirmed: “We are well on track to meet the April 2025 connection deadline for our DC solutions, which include the Master Trust as well as Aon’s group personal pension, Bigblue Touch, and our other DC solutions.

“Aon is positive about dashboards as a force for good in UK pensions, with the opportunity to help employees understand more about their existing provision and to nudge members to engage more with their pension via their providers’ websites or their employer.”

In preparation to connect to the dashboards ecosystem, Aon and Aegon have completed a robust analysis of the complex rules and standards required to connect compliantly.

They have established their data-matching criteria, created new data lakes to facilitate customer matching, and established the customer journey where a possible match is returned.

The current focus for both is on completing and testing connectivity and shaping the support offered to customers who have used a dashboard, helping them understand what the information means for them and the next steps to help them achieve their desired retirement outcome.

But Aon is also thinking ahead.

“More airtime needs to be given to what might happen after launch to ensure dashboards deliver the benefits they should,” Pugh said.

“Careful thought should be given to the end consumer and protections put in place so that ordinary people don’t get bombarded by a wide range of industry firms all eager for them to use their dashboard.

“This could cause confusion and disengagement, instead of being the step forward that dashboards should be.”

Understanding DC pension incomes

Whichever dashboard I end up choosing to use, the estimated retirement income (also known as the ERI) that I see for my Aon Master Trust pension will not go up in payment and will not continue to a surviving spouse or partner after I die. This is in line with statutory requirements – all DC pension incomes will be estimated on this basis.

Why? Because that’s the basis that the Financial Reporting Council’s Actuarial Standard Technical Memorandum 1 says all providers must adopt for their statutory money purchase illustrations.

The data elements in the PDP Data Standards include two flags on this, but they’re only flags:

-

ERI increase (element 2.311): an indicator to show if the income amount increases in payment.

-

ERI survivor benefit (2.312): an indicator that the benefit value shown also has survivors’ benefits.

We know the data that will be provided to the ecosystem, but we don’t yet know for sure how the PDP Design Standards will require dashboards to display that data to consumers.

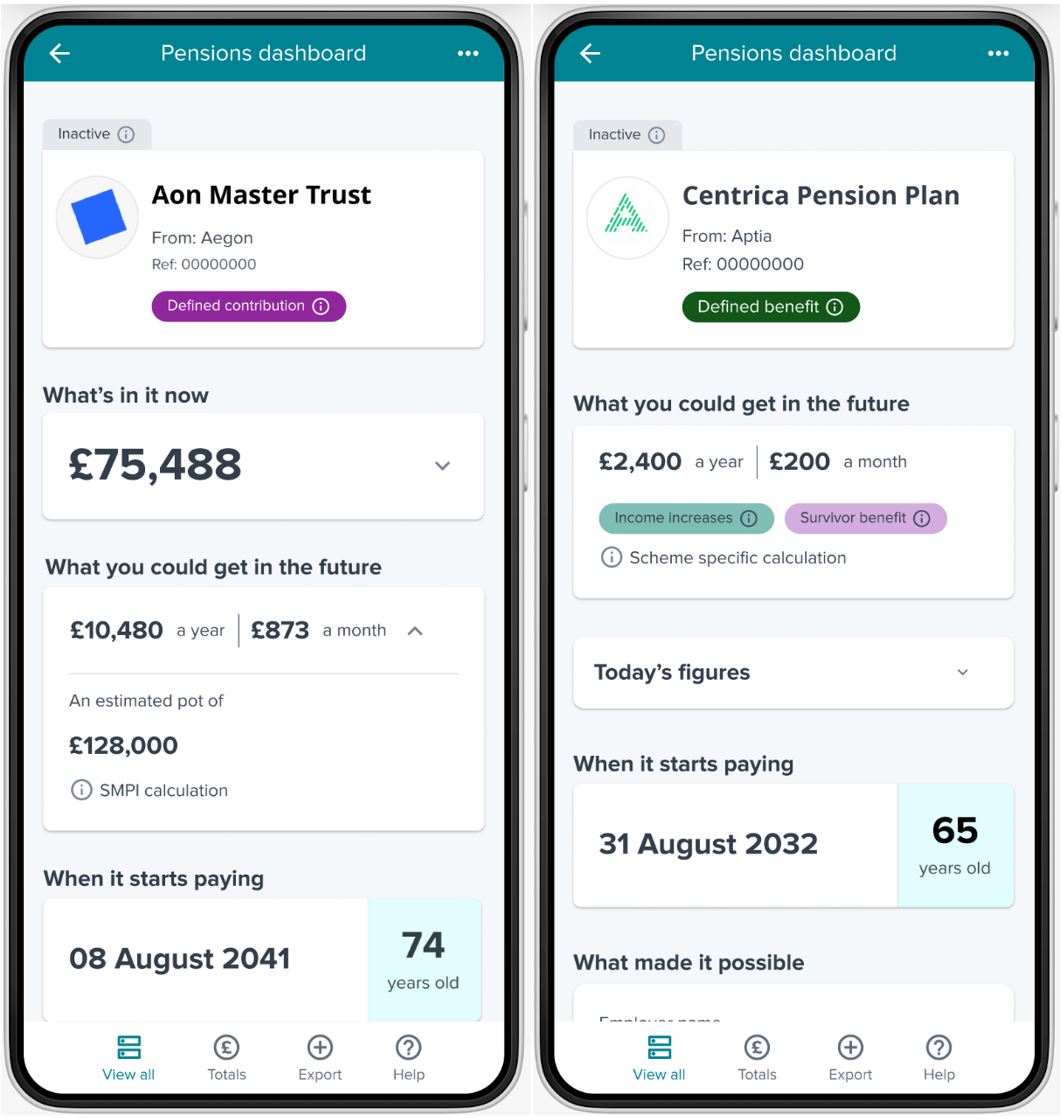

However, based on the draft standards, below is one possibility for how the information might appear.

On the left is my Aon pension showing the possible detailed display of DC pensions. On the right is how one of my deferred defined benefit (DB) pensions might appear. (More on this DB pension in next month’s article.)

Notice how, underneath my £200-a-month Centrica DB pension, there are green and pink lozenge information buttons, indicating this pension will increase in payment and could continue post-death.

However the PDP Design Standards settle on this, the question remains: to what extent will most users understand that the estimated DC pension incomes they see on dashboards stay level in retirement and stop on death?

Spouse’s pensions and income increases

How would you want to see DC pension incomes shown?

I have some personal experience of this as, unusually, I became a pensioner at the young age of 46.

My lovely wife Heather died in 2014, so I’ve been in receipt of a spouse’s pension for over 10 years. It’s gone up by around a third in that time, which has really helped with rising council tax and utility bills. And the fact I receive it at all – which has been a godsend as a single parent – is a very valuable thing.

So, from personal experience, I can tell you: for me at least, pension increases matter, and spouse’s pensions matter, whether they’re paid on death in service, death in deferment, or death in retirement.

Aon feels this is an important topic too and believes consumers should see such income options on dashboards.

In its 2022 response to the FRC, Aon said: “Dashboards would be more successful if it’s clear what alternative [incomes] might provide, e.g. an annuity increasing each year with an attaching spouse’s pension, or how long the pot might last if that same level of income was taken as drawdown.”

The dashboards of the future

“We expect evolution to be rapid and for dashboards in the late 2020s to look quite different to those at launch.” - Tony Pugh, Aon

Pugh said: “We see dashboards’ initial launch as a catalyst for substantive further development as dashboards evolve, based on actual user experience and feedback. We expect this evolution to be rapid and for dashboards in the late 2020s to look quite different to those at launch.”

How might the display of DC pension incomes evolve in the future? How have other countries’ dashboards helped consumers understand the impact of non-increasing DC pension incomes?

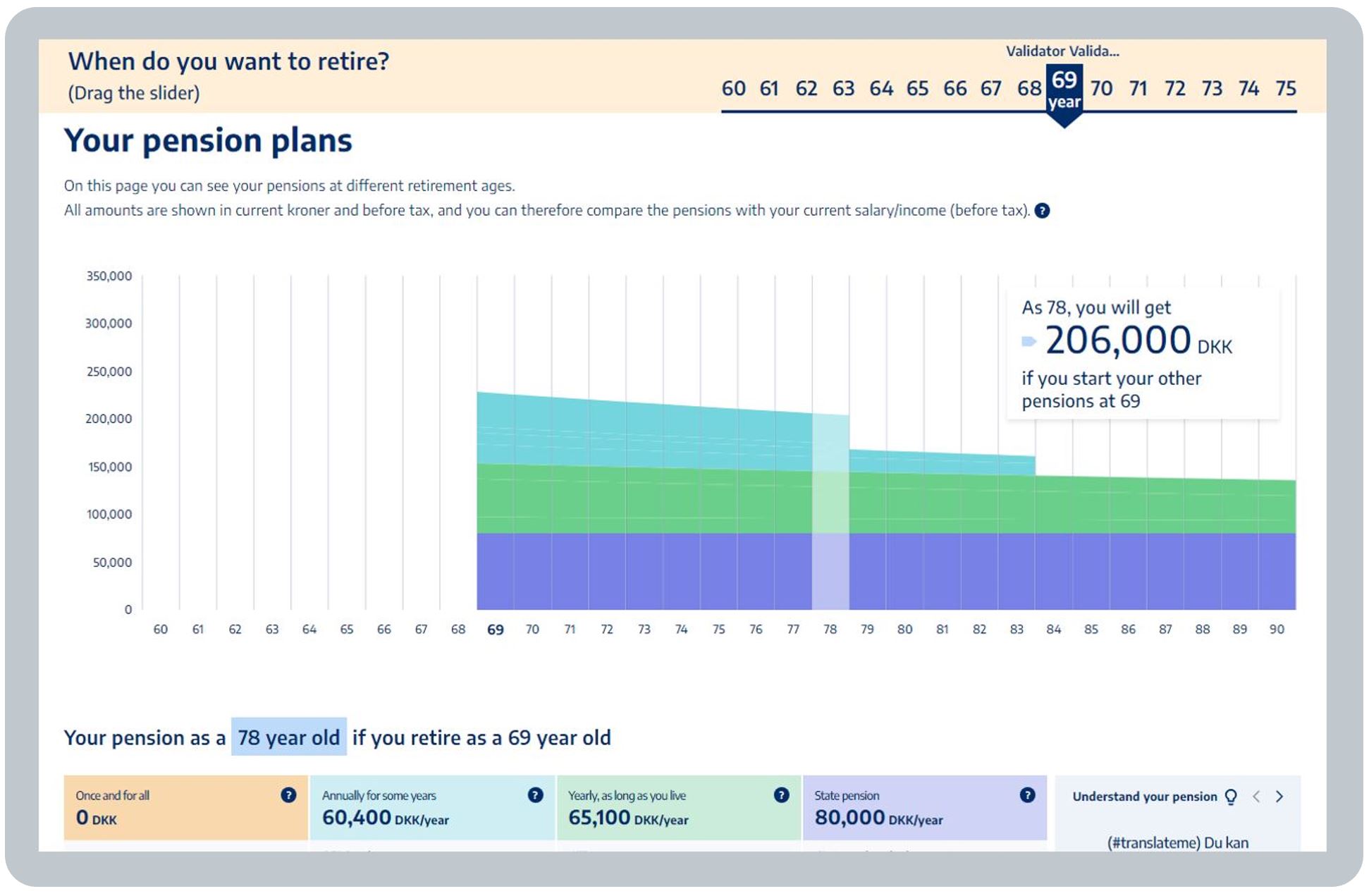

One example is PensionsInfo.dk, the Danish dashboard.

After extensive testing with consumers, the latest iteration of the now 25-year-old Danish dashboard graphically shows how the spending power of level incomes decreases over time: see the blue pension in the timeline below.

Aren’t all DC pension incomes an estimate?

I was struck by a 2019 MoneySavingExpert article (now unavailable online), which stated that “projections of DC incomes are based on complex assumptions that may not prove realistic […] A simple alternative is to [use] what experts think is a safe withdrawal rate of 3.5% a year, or divide the DC pot by about 30”.

Five years on, 3.5% might be a rather cautious withdrawal rate, but mightn’t most consumers find a rough-and-ready drawdown income calculation more understandable than an estimated level single life annuity?

User testing, and live usage experience, will show what most consumers understand.

Like the majority of people (according to the FCA’s 2023-24 retirement income market data), my starting point for how I think I will take my DC pensions is drawdown, rather than an annuity.

And because I’m not aiming to buy an annuity in my mid-60s, I don’t want my DC pensions’ investments to target annuity purchase. As a rough-and-ready way to avoid this, I’ve switched my selected retirement age to 74 for my DC pensions, even though I’ll likely take drawdown before then.

This age of 74 means my DC estimated retirement income annuities are estimated at age 74, which is a bit confusing.

User testing will help show us what most consumers make of the DC incomes shown on dashboards, as well as the other income options available.

For now, to see these options, users will need to click through to their different providers’ websites.

Next month, we travel further back in time to the first of my deferred DB pensions from the 1990s, presenting a whole new set of issues in relation to revaluation. I can’t wait!

Richard Smith is an independent pensions dashboards consultant.

Dashboards Nine-Nine: How Nest is preparing for connection day

With nine months to go to the first dashboards connection deadline, independent pensions dashboards consultant Richard Smith presents the first in a series of profiles exploring how firms are preparing.

- 1

- 2

- 3

Currently

reading

Currently

reading

Aon’s dashboard approach and the importance of DC income

- 5

- 6

- 7

- 8

- 9