All Costs and charges articles – Page 23

-

News

NewsBT takes the value for money debate to its members

BT Pension Scheme has tabled a roadshow to gather its members' views on how they define value for money, in a wider effort to boost engagement.

-

Opinion

How DB schemes can offset end of contracting-out costs

The end of contracting out means extra costs for defined benefit sponsors and members. CMS Cameron McKenna’s Johanna Clarke and Keith Webster reveal how employers can ease some of the pain.

-

Features

Havering makes about-turn on pooling

London Borough of Havering Pension Fund has reversed its original decision not to join the London Collective Investment Vehicle, making it one of the last of the city’s schemes to take this route to reduce manager fees.

-

News

Existing ties still a powerful influence in fid man appointments

Competition for fiduciary management has been bolstered by a rise in open tenders but existing relationships continue to be a dominant driver behind schemes’ choices and questions remain over the value of the approach.

-

Opinion

OpinionRegulator: Coding for quality — how we’re supporting DC

Talking Head: The Pensions Regulator’s Andrew Warwick-Thompson shares the latest on the Pensions Regulator’s revised DC code of practice, reveals findings from its survey on transfers and exit fees, and says where to get help for understanding new DC charges.

-

News

NewsAsset insourcing saves LPFA 75% on fees

FT Investment Management Summit: The London Pensions Fund Authority could run as much as half of its assets in-house within the next three years, cutting the fees charged on those assets by three-quarters.

-

Opinion

OpinionLPFA: Seize the opportunity

The LPFA’s new chair, Sir Merrick Cockell, says the argument for change across the LGPS is undeniable and schemes should seize the opportunity.

-

Opinion

The DC Debate – does the future offer greater freedom, or further restrictions?

In this instalment of the DC Debate, our eight panel members discuss the effects of the new freedoms, continued legislation and compliance, and which value-for-money products are in the pensions pipeline.

-

Opinion

The science behind DC redesign

DC Investment Quarterly: The introduction of freedom and choice and the charge cap this year marked two profound changes to the defined contribution marketplace, affecting both what DC investment products will be expected to deliver and the limits within which they have to deliver them.

-

News

VAT burden shows little sign of abating as key deadline approaches

News Analysis: Employers need a better way of reclaiming VAT on behalf of their schemes than that set out by HM Revenue & Customs, lawyers say, as a December deadline for schemes to renegotiate service contracts looms.

-

Opinion

OpinionSomething's gotta give…

Editorial: At least that’s the message from UK plc, which is sounding off about the detrimental impact of the living wage coming into force next April.

-

Opinion

OpinionThe AE commission and consultancy charges conundrum

Who pays the tab for auto-enrolment remains a tricky problem. Perhaps it is time to look Down Under for the solution, says Mercer’s Gail Philippart.

-

Opinion

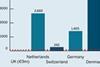

OpinionScheme fragmentation more stark in private sector than public

Data Crunch: The appointment last month of Edi Truell as the London Mayor’s new adviser on pensions and investments is part of an initiative, we are told, to amalgamate some of the country’s numerous public sector pension funds and aims to save billions of pounds through greater efficiencies, lower fees and improved returns.

-

News

Invensys extends Pie to pensioners

Invensys Pension Scheme is expanding its pension increase exchange offering to retired members, as the company plans a bulk exercise for dependants and pensioners.

-

Opinion

Transaction charges: What? Why? When?

From the blog: Debate about the disclosure of transaction charges has made waves across the pensions industry this year. Will the autumn bring a fresh set of challenges and paperwork for trustees and independent governance committees? Or is it possible to draw answers from information already out there?

-

Opinion

Holiday reading: Transfers and exit charges – consultation basics

From the blog: The government has today launched a 12-week consultation into pension transfers, early exit charges and the provision of financial advice.

-

News

LGPS sharpens focus on collaboration as consultation looms

News analysis: Local authority schemes are poised for the outcome of a consultation on collaboration which could compel them to pool their investment assets to save on costs.

-

Opinion

Why it is crucial to get a handle on transaction costs

If defined contribution scheme members are to make confident investment decisions they need to be clear on costs, says Mercer’s Andrew Williams.

-

Opinion

LPFA: Government gives vote of confidence to proactive LGPS funds

Talking Head: The government’s decision to reward ambitious funds that deliver savings and strong investment performance is a marker in the sand in addressing LGPS deficits, says LPFA’s Susan Martin.

-

Opinion

OpinionHow to cut costs through shared services

Schemes can benefit from cost efficiency by sharing services with their peers, says PTL’s Matt Riley.