All Contributions articles – Page 26

-

News

Industry finds no easy answers in dividends v deficits debate

Most FTSE 100 companies could clear their pension deficits in less than two years by withholding dividends, new research says. Experts have called for more focus on the contrast between dividend payments and deficit repair contributions, though others say there is no one-size-fits-all solution.

-

Opinion

What to look out for with age-based contribution structures

As defined contribution schemes are now often the sole pension scheme open to employees, DC scheme design, including the option of having age-related contributions, takes centre-stage. So what needs to be kept in mind to avoid age discrimination?

-

News

NewsContribution hike prompts pension protest at Bangor University

Public sector union Unison has protested against Bangor University’s plans to raise pension contributions, but despite the demurral, changes will be going ahead this month.

-

Features

Consolidation and partial transfers put forward as funding pressures increase

Defined benefit funding levels have not improved over the past years as gilt yields have fallen, the latest edition of the Purple Book shows, with industry figures hailing partial transfers and scheme consolidation as possible solutions.

-

News

Select committee sets sights on gig economy

The Work and Pensions Committee has this week launched an inquiry into self-employment and the so-called gig economy, focusing on pensions as well as universal credit, support and labour market participation.

-

News

NewsAlstom energised by employer guarantee and extra contributions

The Alstom Pension Scheme has agreed an increase in recovery plan contributions following a drop in its funding level, but the decision has been buoyed by a strengthened sponsor guarantee.

-

News

Company disclosures lack detail, report concludes

Companies need to provide more information on their defined benefit pension obligations, experts have said, after a study by Lincoln Pensions revealed a lack of clarity on many key issues.

-

Opinion

OpinionHow members' mental health issues affect pension schemes

Any Other Business: Every year 70m working days are lost due to mental health, while a quarter of people consider resigning due to stress, according to the Mental Health Foundation, so how do work-related mental health issues affect pension schemes and employers?

-

Opinion

OpinionHow bright is the future for AE – the DC Debate part 1

In the third DC Debate of 2016, seven defined contribution experts reveal their thoughts on automatic contribution increases, small businesses which mean business, and the possibility of Nest entering the decumulation market.

-

Opinion

OpinionHow to keep on top of an ageing workforce

Over-50s are set to become the dominant age-group in the UK’s workforce, new analysis has shown, leading to potentially dramatic changes for employers and trustees.

-

News

Experts eye hedging and CPI as UK DB deficit up £170bn in weeks

UK defined benefit pension deficits grew by £170bn over seven weeks in the run-up to the EU referendum, jumping to £900bn as market volatility following the result put further strain on funding positions.

-

News

Landmark SPPA ruling sets gender equality precedent

The Scottish Public Pensions Agency has ordered North Lanarkshire Council to treat back pay settlements issued to female employees following years of salary discrimination as pensionable.

-

Opinion

OpinionIs this the mastertrust’s time?

David Snowdon of fiduciary manager SEI outlines the case for the mastertrust as a savings vehicle, and explains how the sector is likely to change in coming years.

-

Opinion

OpinionTime to shoot the messenger

From the blog: Communications can help people get to grips with their long-term savings objectives, but if we do it the wrong way our attempts to help could fail – no matter how important the message.

-

News

NewsStaveley agrees £73.6m recovery plan

The Staveley Pension Scheme has agreed a new, £73.6m recovery plan with its sponsoring employer after its most recent actuarial valuation found a £100m deficit.

-

Opinion

OpinionThe other pensions problem

At some point in the last few years, pensions became a big news story. Updates on BHS, Tata steel and others fill airwaves and pages (including our own).

-

News

NewsShould you pay higher DC contributions to spur retirement?

Any Other Business: Lower employer contributions to defined contribution pension schemes can lead to “massive” challenges in paving the way for older workers to retire and injecting new blood into a business, experts have said.

-

News

NewsNetwork Rail plans £19m savings following NI cost hike

Network Rail expects to save around £19m annually following a swath of amendments to two of its schemes to mitigate the increased costs of contracting-out cessation, as many schemes either absorb the cost or close.

-

News

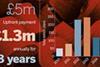

Nilgosc to allow lump sum contributions

The Northern Ireland Local Government Officers Superannuation Committee plans to ask for upfront deficit contributions for this year’s LGPS valuation from its employer members as the public sector in Northern Ireland shrinks.

-

Opinion

OpinionAchieving better outcomes – where should the burden lie?

Asset manager AB’s David Hutchins explains why providers and trustees should focus on value for money rather than mere cost savings.