All Consultants articles – Page 8

-

Opinion

OpinionData crunch: Who advises the DC scheme community?

SpenceJohnson’s Magnus Spence looks at how the advisory market is developing and explains why second-tier firms are gaining ground with defined contribution schemes.

-

News

FCA wants to strengthen duty on managers and consultants

About £109bn of investor assets is held by managers who charge high fees but do not offer significant variation from an index-tracking strategy, the Financial Conduct Authority’s interim report on competition in the asset management market has found.

-

News

Select committee inquiry: What should change to safeguard DB?

As the deadline for submitting views on defined benefit to the Work and Pensions Committee has passed, experts say there is a need for greater flexibility, potential benefit reductions and increased powers for the Pensions Regulator.

-

Opinion

OpinionHow can schemes ensure they get impartial advice?

Eversheds’ Mark Latimour outlines what trustees must ask their advisers – and themselves – to ensure conflicts of interest do not influence advice.

-

News

Member-borne commission ban could move costs elsewhere

The Department for Work and Pensions has launched a consultation on draft regulations for banning member-borne commission in auto-enrolment schemes, but experts said costs would still need to be shouldered elsewhere.

-

Opinion

OpinionWhen knowledge is power: how to manage your advisers

Independent Trustee Services’ Janine Wood looks at whether your consultant has too much say in your scheme and how that could change.

-

News

Is groupthink at play on your trustee board?

A desire for conformity could stifle debate in trustee meetings, new research has suggested, but industry experts say lay trustees are encouraged to challenge the status quo.

-

Opinion

How can we reassure trustees on the more complex aspects of delegated investing?

Roundtable: William Parry from Buck Consultants, HR Trustees’ Giles Payne, Russell Investments’ David Rae, Ralph McClelland from Sackers and Towers Watson’s Pieter Steyn, consider the more difficult elements of fiduciary management, in the second part of this roundtable series.

-

Opinion

OpinionAnd now for the weather…

From the blog: I described in a previous blog a game of epic procrastination that pension schemes like to play: Not Today, Tomorrow Better!

-

Opinion

Johnson: Pension ostriches need a shakeup

Letter: Robert Gardner’s excellent article ’Collective response to an unprecedented problem’ screams ‘unsustainable’: something has got to give. The question is what?

-

News

Defying criticism: The other burden of being a lay trustee

Any Other Business: Lawyers, actuaries, professional trustees. The world of pensions is so full of highly specialised roles it can seem bizarre so much of the decision-making comes down to elected trustees who may have no experience with pensions.

-

Opinion

OpinionWhy the pension consultancy market is a true oligopoly

From the blog: “Investment consultants have contributed to the poor performance of UK employer-backed pension funds by offering the same advice at the same time,” asserted a recent article in the Financial Times. And I could not agree more.

-

Opinion

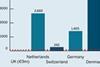

OpinionScheme fragmentation more stark in private sector than public

Data Crunch: The appointment last month of Edi Truell as the London Mayor’s new adviser on pensions and investments is part of an initiative, we are told, to amalgamate some of the country’s numerous public sector pension funds and aims to save billions of pounds through greater efficiencies, lower fees and improved returns.

-

Opinion

How to get more from your LDI mandates and manager

Liability-driven investment managers could be made to do more for their money, says Paras Shah.

-

Opinion

OpinionSix test points for comparing fiduciary managers

JLT Employee Benefits’ John Finch gives six top tips for trustees to consider when choosing a fiduciary manager.

-

Opinion

Is fiduciary management right for your scheme?

The fast-growing world of fiduciary management can be a controversial topic for pension schemes.

-

Opinion

OpinionWhy schemes should seek real fiduciary management

What observations can we make as fiduciary management in the UK gets ready to take off its training wheels, with early adopters having racked up a few years’ experience and an ever-increasing acceptance of the model among UK pension plans?

-

News

Data suggest schemes would rather fail conventionally than break from herd

Fear of being alone in making a mistake is driving pension funds to knowingly follow ineffective manager recommendations from investment consultants, according to academics.

-

Opinion

How a secondary market is starting to change fid man

Mercer’s Michael Dempsey outlines how schemes can benefit from fiduciary management’s secondary market, brought about by rapid growth in the sector.

-

News

Leicestershire to commit entire credit portfolio to direct lending

Leicestershire Pension Fund plans to move its entire credit portfolio into direct lending as it makes a further £100m investment in an asset class increasingly targeted by yield-starved pension funds.