All Aon articles – Page 19

-

Opinion

What overseas DC systems can tell us about the post-Budget landscape

The retirement flexibility brought about by the Budget has left many schemes wondering how to best implement the at-retirement options.

-

News

Low-cost passive DC loses ground as schemes seek ‘smoothed’ returns

The number of FTSE 100 trust-based defined contribution schemes using lower-cost, fully passive management for their default options has dropped by almost a half as diversified growth funds become more popular, research has found.

-

Features

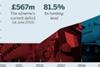

FeaturesLafarge doubles contributions to cut deficit

Building materials manufacturer Lafarge has more than doubled its contributions to its UK pension fund after scheme and sponsor negotiated a beefed-up recovery plan to tackle the funding deficit.

-

Features

FeaturesMineworkers scheme extends cash buffer to battle rising longevity

The Mineworkers Pension Scheme has secured a 10-year extension to the repayment deadline of its government-backed investment reserve, as it works to manage increased longevity among scheme members.

-

News

Schemes eye hedge funds in hunt for return certainty

Global institutional investor sentiment is moving towards hedge funds as pension schemes look for less volatile equity returns, with larger investors favouring bespoke blended manager mandates.

-

Features

FeaturesStrathclyde rebalances bond portfolio in drive for greater returns

Strathclyde Pension Fund has decreased its allocation to corporate bonds in favour of a wider absolute return bond strategy, to rebalance its portfolio as spreads tighten.

-

News

Multi-asset exposure surges as schemes focus on volatility

The proportion of pension schemes with multi-asset fund exposure has risen to 83 per cent, up from 70 per cent just six months ago, as schemes look to control volatility and mitigate macroeconomic risk.

-

Opinion

How to build your risk committee

As more defined benefit schemes follow a derisking plan towards their end point, monitoring and managing risk grows ever more important.

-

News

NewsEmployers consider RPI/CPI switch as gap widens

Consultants have reported more employers trying to overcome the difficulties of switching from using the retail price index to the consumer price index to reduce scheme liabilities as the gap between the two measures widens.

-

News

Consultant-provider collaborations create AE quandary

News analysis: Employers and schemes approaching auto-enrolment face a unique governance challenge as consultants and providers club together to provide off-the-shelf products, with industry commentators raising questions on independence and cost.

-

News

European investors hunt alternatives to diversify growth assets

Data analysis: Fixed income attracted the most money from European investors last year, but alternatives won on future allocations as schemes look to derisk and diversify portfolios.

-

Opinion

Managers pick best value EMD countries for 2014

For those who desired an object lesson in asset correlation and the worth of diversification under pressure, emerging markets have delivered.

-

News

Data analytics use on the rise to inform investment decisions

Four in five institutional investors have increased the use of data analytics in the past three years to inform investment and risk-management decisions, and to meet tougher regulatory requirements.

-

Features

Plumbing scheme offers lower contribution rate to tempt employers

The Plumbing and Mechanical Services Industry Pension Scheme will offer a lower contribution scale to new employers joining the career average scheme, to help it compete with defined contribution arrangements.

-

News

Equity market growth sees schemes rerisking

Data analysis: Schemes were rerisking in the last quarter of 2013 as they sought to benefit from rising equity markets to improve their funding levels.

-

News

Scheme ETF usage picks up but obstacles remain

News analysis: More schemes are using exchange traded funds as part of a tactical investment strategy, industry members have observed, but there are still barriers in cost and governance.

-

News

Infrastructure top of agenda despite hurdles

Data analysis: Defined benefit and defined contribution schemes are once again circling infrastructure investments, but a lack of underlying assets and suitable funds – especially for DC investors – is holding back inflows.

-

News

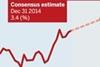

NewsSchemes urged to lock in gains as market improves

Special report: Pension schemes could see a further 40 basis point jump in gilt yields by the end of 2014, improving their funding levels and derisking value.

-

Features

Essex merges functions after admissions rise

Essex Pension Fund has combined its employer, investment and administration teams into a single structure to deal with an increased number of employers joining the scheme.

-

News

Findel uses auto-enrolment to chisel down costs

Home retail and educational materials supplier Findel has overhauled its existing pension offering to generate savings that will help shoulder the costs of auto-enrolment.