All articles by Angus Peters – Page 18

-

News

CMA: Fiduciary management not overly concentrated

Neither the investment consultancy or fiduciary management industries show signs of excessive concentration, the Competition and Markets Authority has found, but the vertical integration of the ‘big three’ firms could distort the market in future.

-

News

Salvus snaps up Complete in £7m mastertrust consolidation deal

Salvus Master Trust has unveiled plans to acquire the members and assets of the £7m Complete Master Trust, as the sector’s consolidation drive begins to gather pace.

-

News

Now Pensions default struggles as industry lacks standardisation

Now Pensions has the worst performing default fund of any major defined contribution provider, according to a new report by product review company Defaqto.

-

Opinion

Roundtable: How can schemes prepare for uncertainty in fixed income?

What does the end of an unprecedented era of quantitative easing have in store for interest rates, and how should increasingly mature defined benefit schemes adapt? PGIM’s Edward Farley, Barnett Waddingham’s Sophia Heathcoat, MJ Hudson Allenbridge’s Anthony Fletcher, Independent Trustee Services’ Dinesh Visavadia, Bestrustees’ Graham Wardle and independent trustee Alexandra Martinez discuss.

-

Features

Has the industry kept its promise on at-retirement innovation?

Analysis: When the Department for Work and Pensions allowed the industry to block mastertrust Nest from entering the drawdown market in 2017, it did so with a proviso; the industry had to drive innovation itself.

-

News

RSA calls for pensions tax reform to boost saving for self-employed

The Royal Society of Arts has published wide-ranging recommendations seeking to tackle the four key barriers to saving for the self-employed, underpinned by a call to introduce a flat rate of tax relief on pensions contributions.

-

News

UK could profit from Australia’s missed default opportunity

A default drawdown proposition rejected by the Australian government could offer “freedom from the pension freedoms” for unengaged savers who cannot afford advice at retirement, it has been claimed.

-

News

Choosing the right derisking path

Analysis: Consultants say bulk annuity pricing has never been so attractive, yet the majority of pension schemes see self-sufficiency as their likely destiny. Who is wrong?

-

Features

Pearson follows pack in targeting drawdown for DC defaults

The Pearson Pension Plan is introducing two new lifestyle options for its defined contribution members as they approach retirement, responding to a perceived demand for greater flexibility.

-

News

Default drawdown tops select committee's at-retirement wishlist

Providers of drawdown products should be required to develop charge-capped default products to help disengaged savers make their pension last, the Work and Pensions Committee has recommended.

-

News

Can schemes still justify active management?

The average active fund manager cannot outperform their benchmark net of fees, and according to the Competition and Markets Authority, the average investment consultant cannot reliably identify those managers who do. Can an average trustee board reasonably keep the faith in active management?

-

News

The Pension SuperFund: Benevolent disruptor or danger to members?

If assembling a star-studded team of executives is enough to get a radical new pensions proposition off the ground, Edi Truell might already have done enough to disrupt the UK defined benefit sector.

-

News

NewsFines for DB negligence leave industry split

Employers who wilfully or recklessly put their defined benefit pension schemes at risk are in the firing line of new punitive fines announced in a government policy statement released on Monday.

-

News

Govt 'tempted' by latest Royal Mail CDC proposals

The Department for Work and Pensions is “tempted” to lay regulations facilitating the creation of collective defined contribution schemes, following a recent breakthrough by the team drafting proposals on behalf of Royal Mail.

-

News

Councils fear loss of control under London CIV proposals

The London Collective Investment Vehicle has announced a number of upgrades to its governance structures in response to personnel changes, but local authority participants still have fundamental concerns about how investing in the pool will work.

-

Features

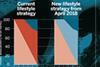

FeaturesJLR drives down costs with DC strategy refresh

UK automotive stalwart Jaguar Land Rover has embarked on a complete overhaul of its defined contribution offering in a bid to drive down costs and improve member outcomes.

-

News

Cold-call ban needs hefty fines to work, experts say

The government's decision to speed up its ban on cold calls and emails related to pensions must be supported by credible regulations and deterrent fines if consumers are to be protected, industry commentators have said.

-

Features

Solving consultancy's transparency problem

Analysis: The first findings to be presented by the Competition and Markets Authority show that no one is squeaky clean in the investment consulting and fiduciary management businesses. How can both products become more transparent?

-

News

DWP to allow bulk DC transfers without member consent

The Department for Work and Pensions has pressed ahead with regulations easing the bulk transfer of defined contribution members without their consent, seen as a milestone in a drive for scheme consolidation.

-

Opinion

Pensions industry still behind on gender pay gap

Analysis: The pensions industry is slowly publishing its gender pay gap data, and it does not make for pleasant reading.