Risk management should not just focus on assets

Data Crunch: As defined benefit pension schemes have matured they have become increasingly risk-aware. This awareness of risk is not just limited to those schemes’ asset portfolios, but also their liabilities and sponsor covenants.

With encouragement from the Pensions Regulator, schemes are increasingly adopting an integrated risk management approach that considers these risks holistically.

Defined contribution schemes are a lot further behind DB in providing the tools members need to assess their own financial wellbeing, and the role of their pension within it.

DC remains a long way behind DB in providing a coherent risk management framework for members

Integrated risk management is the process of examining the common risk factors that affect a scheme’s assets, liabilities and sponsor covenant, so that concentrations of risk affecting the overall financial position of the scheme can be identified and then addressed.

Negative numbers do not mean negative results

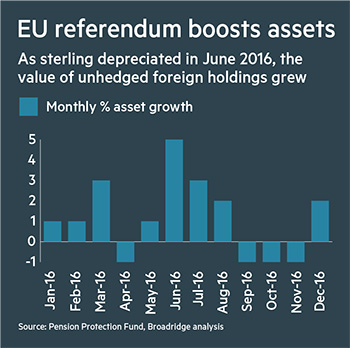

Currency risk is a common factor affecting multiple elements of a DB scheme’s financial position. One unexpected consequence of the June 2016 EU referendum result was a significant boost in UK DB pension assets.

In June 2016 alone, DB pension fund assets increased by more than 5 per cent, largely resulting from the depreciation of sterling boosting the relative value of unhedged holdings of foreign assets.

Yet the gain is not unambiguously positive: this currency movement may have been detrimental to scheme covenants if their sponsor’s business was negatively affected (for example if the sponsor’s business was a net importer from Europe).

A factor that impacts all three pillars of the IRM framework is interest rate risk. The boom in liability-driven investing in recent years has been hugely successful in helping schemes manage interest rate risk across both their assets and liabilities.

But interest rates also impact employers’ cost of borrowing, and therefore a scheme’s sponsor covenant. An integrated risk management approach would take this into account.

ESG risks affect covenant and liabilities

Environmental, social and governance factors can also be considered within an IRM approach. There is a growing consensus that environmental considerations will have a material impact on long-term financial returns and schemes are duly accounting for it in investment decisions.

Some schemes will be exposed to similar risks through their sponsor covenants; oil and gas companies may be at risk from future regulations aimed at transitioning economies away from fossil fuels and towards renewables.

Links have even been found between climate change and longevity, indicating that climate risk may also affect scheme liabilities.

DC schemes lag behind

IRM is applicable to DC, but a key issue is that it is difficult for a member or trustee to assess how their pension fits within their broader financial position.

It is up to members to make complex assessments of the relationships between their DC savings and their other assets, their estimated future retirement spending needs (ie their ‘liabilities’) and their current and future income (ie their ‘covenant’).

Individuals need to find answers to questions such as: ‘Does it make sense to invest my DC pot in property funds if I am heavily invested in property through owning a personal residence?’; ‘Should my DC pot be invested in financial stocks if I am exposed to this industry through my employment’; and ‘Should I be locking up my assets in a pension scheme to meet uncertain long-term post-retirement spending needs, when I may also have substantial uncertain short-term spending needs?’.

It is encouraging that DC schemes are increasingly embracing concepts such as financial wellness and providers are designing propositions that combine a DC pot alongside other financial products such as liquid savings accounts.

However, DC remains a long way behind DB in providing a coherent risk management framework for members.

Jonathan Libre is a principal in Broadridge’s EMEA Insights team