Mid-market direct lending is “now demonstrating signs of material deterioration in credit underwriting and future return potential”, according to a report by consultancy Willis Towers Watson, which is instead recommending its clients invest in debt for US real estate and UK commercial real estate.

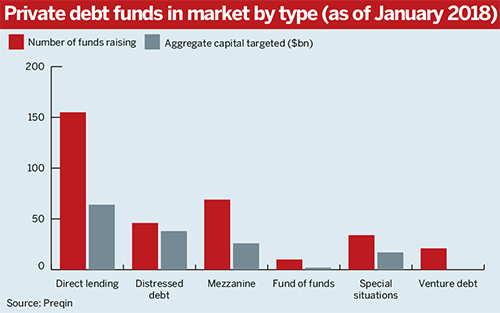

According to intelligence provider Preqin’s 2018 Global Private Debt Report, 45 per cent of fund managers say it is now more difficult to find attractive opportunities in the asset class than 12 months ago.

From a DB perspective, it’s been exceptionally popular for clients

Ross Fleming, Hymans Robertson

Private debt assets under management across the globe have surged to $638bn (£500bn) as of June 2017, up from $205bn (£160.7bn) at year-end December 2007, Preqin research shows.

WTW is urging investors to find borrowers “with a genuine and credit-positive need” for capital.

The WTW report said that with the market growing rapidly, it is not easy to understand its complexities. The consultancy said this is why the majority of institutional investors have concentrated their activities in mid-market corporate direct lending. "We feel this approach is much too constraining," it said.

The US offers a potentially lucrative market, according to some experts, where schemes may look to replace banks that have cooled their lending activities.

Schemes can replace cautious banks

The consultancy continues to advocate investment in private debt, which offers “good value”, according to Gregg Disdale, head of alternative credit at WTW.

There is, however, “less value to be found today” in the more accessible offerings in the asset class, “notably direct lending”, he observed.

“We are seeing a deterioration in credit quality in that space,” he said, which is “a natural consequence of what you’re seeing in syndicated loan markets”, where underwriting has also worsened.

Real estate debt finance instead offers an opportunity for schemes to take advantage of shifts in banks’ behaviour and access the asset class. Residential real estate in the US has faced regulatory tightening that has restricted credit availability.

“We think that has led to borrowers who should be able to get credit being unable to, and that has opened up an opportunity for institutional investors to come in and provide that capital,” he said.

The consultancy has recommended US residential mortgages for the past four years. Short-term lending against UK ‘change of use’ commercial properties are also in favour with WTW.

“The reason the opportunity exists is that property is not typically generating any income and therefore the banks just don’t really want to be in that business anymore,” in part owing to the amount of underwriting required, Disdale said.

Schemes can also help the banks

Certainly, pension schemes in both the defined benefit and defined contribution areas have already begun to shun more conventional investment opportunities in favour of niche products.

Regulatory capital investment, where schemes step in with loans to assist banks in meeting capital requirements imposed in the aftermath of the 2008 financial crisis, is one example of more unorthodox investment behaviour from schemes.

Scheme interest in private debt is ongoing. Last year, the Shipbuilding Industries Pension Scheme made a £50m commitment to private debt.

Meanwhile, DC mastertrust Nest is set to invest into private infrastructure debt.

Ross Fleming, senior investment consultant at Hymans Robertson, said such investments are opportunities to exploit illiquidity and complexity premia.

Real estate debt investment should not automatically go towards “the London office-type, property-type markets, but certainly the regional areas where there’s less money being raised in these markets”, he said.

“From a DB perspective, it’s been exceptionally popular for clients, given that it’s giving you an enhanced yield, it’s giving you an opportunity to diversify away from more traditionally traded credit markets, and also a real opportunity to receive income,” he added.

Strong funding levels facilitate PD investment

Private debt investment has been embraced by the likes of the QinetiQ Pension Scheme. Chaired by Bestrustees director Huw Evans, the fund has taken advantage of its strong funding level to invest both in European and US private debt.

The £2bn scheme's last actuarial valuation at June 30 2017 indicated a surplus of £139.7m. Evans said: “The opportunity arose [in private debt] because we had a substantial improvement in our funding level.”

The fund’s mandates lie with HPS Investment Partners and Partners Group, which stand at “about £80m” and “in the tens of millions” respectively, according to Evans.

How can pension schemes support banks?

Analysis: Around 30 banks have entered into bank capital relief transactions with institutional investors, according to consultancy Aon, with the size of the market estimated at about £20bn, and continuing to grow rapidly.

“It’s consistent with the general derisking and the focus on generating cash flow,” he added.

HPS offers the scheme its European exposure, while the Partners mandate consists of private debt investment in the US.

“Private debt has worked well,” the independent trustee said, adding" “I wouldn’t really have many qualms about doing it on other funds.”