While everyone acknowledges the incredibly high price of gilts in the current environment, which is wreaking havoc with pension scheme funding levels, few have taken the controversial move of getting rid of their allocation to bonds altogether.

However, this is what the Lancashire Pension Fund has done, opting instead for an allocation that combines equities, property, infrastructure and credit strategies.

Solvency II regulation and other things are forcing a bid for those long dated assets for matching purposes... All you’re doing is depleting your assets over time

Trevor Castledine, Lancashire Pension Fund

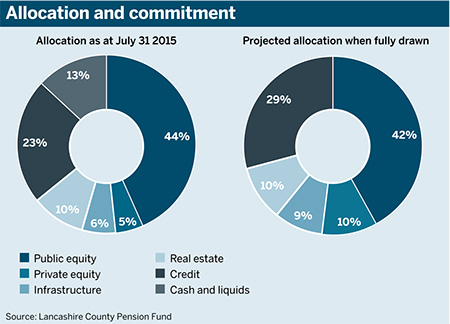

Initiated in 2012, the scheme’s new investments have almost completed drawing down, increasing its allocation to those asset classes.

As part of the Local Government Pension Scheme, the Lancashire fund is administered by a local authority – Lancashire County Council – with a statutory pensions committee ultimately responsible for scheme decisions.

The 30-strong committee determines the ‘statement of investment principles’ but has a delegated investment management panel making decisions within fund boundaries.

Trevor Castledine, deputy chief investment officer for the scheme, says: “If you look at our top-down asset allocation, it’s drawn in fairly broad bands, and that gives the investment teams some discretion to move within those bands.”

The bands are 40-60 per cent equities, 10-20 per cent real estate and 20-40 per cent in low volatility.

“It’s designed so that if you were at the midpoint of all of [the bands] it wouldn’t add up to 100 per cent, so it forces us to make some decisions about over and underallocation,” says Castledine.

“It’s designed so that if you were at the midpoint of all of [the bands] it wouldn’t add up to 100 per cent, so it forces us to make some decisions about over and underallocation,” says Castledine.

The scheme is targeting an allocation of roughly 50 per cent in equities, of which 80 per cent will be in listed equities and 20 per cent in private equity.

“We are running probably just under 50 per cent in equities at the moment and when the equity markets go down that changes the allocation,” Castledine says.

“Earlier in the year when equities had done pretty well we did sell some to bring ourselves down, so we cashed a little bit of profit.”

However, he adds: “We’re not really active equity traders, we’re long-term investors.”

The scheme also disinvested entirely from gilts and corporate bonds, keeping liquid bond funds and investment grade bonds only, to hold capital earmarked for future investment.

“Solvency II regulation and other things are forcing a bid for those long-dated assets for matching purposes, so it’s a technical supply/demand issue; it means the return on them is… a negative real return,” says Castledine. “All you’re doing is depleting your assets over time.”

Despite this, the scheme still needed long-dated inflation-linked assets, which it found by creating a private housing association in early 2014, providing shared-ownership housing in the UK.

Real asset strategy

Castledine says real estate is virtually all done through direct ownership of commercial properties.

“We’re not quite at 15 per cent yet, but we’ve got an aspiration to grow our allocation.”

He says this would provide an inflation hedge in the long run and provide rental yield.

To avoid the costs associated with investing through large fund managers, the scheme buys property directly, then uses property consultancy Knight Frank to manage them.

Castledine adds although the IPD All Property Index achieved a return of 16.72 per cent in the past year, the scheme wanted to access outperformance through real estate development.

He gave the example of a student accommodation block in Preston and a residential block in Hayes, Middlesex, close to the site of a future Crossrail station.

He stresses that the scheme is not targeting overly esoteric investments.

“We’re not there to shoot the lights out, we’re there to pay the liabilities of our members,” he says.

The scheme also has a local property allocation, investing both for social impact and return.

We’re not there to shoot the lights out, we’re there to pay the liabilities of our members

Trevor Castledine, LCPF

Castledine says the distance from London and size of opportunities mean many of the projects are unappealing to most property firms, but the scheme’s location means it is well placed to capitalise.“We perhaps get to see opportunities where there’s not so much investor pressure, and therefore we believe we can hit our investment targets,” he says.

Investing early in infrastructure and property assets carries with it risks associated with construction, which the scheme mitigates by finding partners with expertise in the given area.

It used a similar method to invest in renewable infrastructure assets, specifically UK-based distressed landfill gas operations. The scheme targets an 8 per cent absolute compounded return from infrastructure over the economic cycle.

“We were given the opportunity to buy them at quite a deep discount,” Castledine says.

The scheme brought in an engineering team and a management team, and then expanded to buy coal mine methane recovery assets from disused mines. The partnering approach was key to the investment going ahead, he says.

“They’re long-term assets, they have income generation, they probably have some inflation linkage to them, but unfortunately the way that people tried to make us invest in infrastructure wasn’t always particularly effective.”

The scheme also invested in a series of global infrastructure funds to “ramp up” the allocation more quickly, but has continued to follow its model of buying direct holdings out of distress, which it can then fix and put a management team in place for.

“Instead of investing through a fund where you pay 2-and-20 to the fund manager, and they still have to do all that stuff, we just do all of that,” Castledine says, adding that finding good partners is crucial.

Making in-roads

Schemes looking to invest directly in infrastructure or property assets often do so through the use of a managed account, where an investment manager finds, buys and manages the asset according to the scheme’s direction.

David Cooper, executive director of debt investments at fund manager IFM Investors, says using managed accounts is suitable for those looking for a more tailored approach than fund investing, but who do not want to recruit their own team.

“Compared with the direct investing approach, they [do not] have to recruit their own team… The advantage compared with a pooled fund is you have more ability to choose where you invest.”

Cooper adds this is especially important in countries such as Spain, where “white elephant” infrastructure is common – projects built for political reasons rather than as a response to demand.

Owen Haggith-Khonje, senior investment analyst for alternatives at fiduciary manager SEI, echoes the need for schemes to use expert teams.

“Not many consultants have the time to do the due diligence and number crunching,” he says.

The Lancashire scheme has since used its approach to invest in a biomass generator in Port Byron, Australia, and is looking at investing in a wind farm.

“Our experiences of the investments that seem to work well have guided our strategy in terms of other things we do.”

Castledine says the scheme was not against investing through funds, but “in an ideal world we will do directly held infrastructure where we then employ the management team”.

Alan Synnott, head of the product strategist team for BlackRock Infrastructure Investment Group, says renewable infrastructure has been an area of strong growth, with assets invested through renewable funds growing to roughly $317.5bn (£208.4bn) at the end of 2014 from $1.1bn in 2004.

Credit strategy

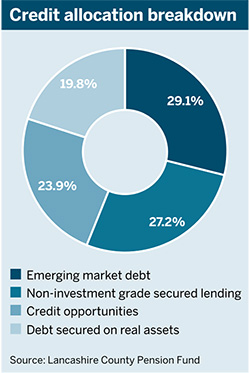

The scheme divides its credit portfolio into four strategies: emerging markets; non-investment grade secured lending; credit opportunities; and debt secured on real assets.

It plans to increase investment in all areas of its credit portfolio, except emerging market debt, but Castledine says the scheme is considering increasing its allocation.

“We retain confidence those positions will recover,” he says, adding that the scheme increased its stake last year and has scheduled a meeting to discuss increasing it again.

Ed Jones, managing director of institutional business at investment manager Neuberger Berman, says direct lending is of increasing interest to pension schemes, especially lending to businesses.

“A lot of that historically has been in the US, but it’s very much a global market. The underlying companies tend to be profitable, market-leading companies.”

Jones says the key attractions of the asset class are the illiquidity premium, diversification, yields and protection in a rising interest rate environment. However, he adds finding the right expertise is critical.

“There are risks with an asset class like this. The key aspect is manager selection.”

Click here to download The Specialist: Investment trends pdf in full