The London Borough of Islington Pension Fund has agreed to reduce its investment in fossil fuels, following lobbying efforts from local environmental activist group Fossil Free Islington.

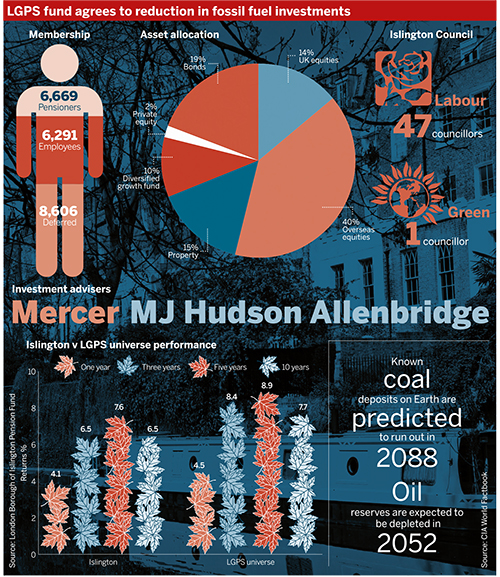

The £1.3bn scheme, which has 21,556 members and 6,669 pensioners, announced on September 12 that it is designing a four-year plan to lower carbon investment and build upon the progress it has already made in reducing its carbon footprint.

Environmental, social and governance factors are becoming increasingly difficult for trustees to ignore. Earlier this month the Department for Work and Pensions introduced new obligations for schemes to show how they address financially material risks in their investment strategies.

I don’t want my pension to become worthless, as oil, coal and gas companies become obsolete

Michael Johnson, scheme member

The Islington scheme has been working with investment adviser Mercer since late November to bolster its ESG credentials. While campaigners have influenced the scheme’s decisions, it remains set on viewing responsible investment issues through the prism of financial risk rather than ethics.

Islington council is made up of 47 Labour councillors and one Green Party councillor. The pension fund committee is entirely made up of Labour politicians.

The board met members of Fossil Free Islington, part of Fossil Free UK, which has local campaigns centred on several London boroughs and councils across the UK. The Islington Pensioners’ Forum also supported the move to divest.

The council has also engaged with the London Collective Investment Vehicle, the Institutional Investors Group on Climate Change and the Local Authority Pension Fund Forum on ESG.

The fund is now exploring investment opportunities in renewable energy and green infrastructure, but has ruled out any further changes to its investment strategy over the next 12 months.

Members pressured fund

Islington is one of a number of local government pension schemes looking to improve the ESG profile of its investment portfolio.

The £1bn London Borough of Hammersmith & Fulham Superannuation Fundhas also agreed to lower its fossil fuel exposure.

In December, the West Midlands Pension Fund agreed to deselect South Korean arms manufacturer Hanwha Corporation from its internally managed passive equity portfolio after allegations Hanwha had sold cluster munitions.

Dave Poyser, who chairs the Islington pension fund committee, said the option of a completely fossil-free index tracker remains on the table for the fund.

“It is to do with the members’ interests,” he said. “If as a by-product there is a benefit to the planet, then that’s good, but everything we do, it is the members’ interests that come first,” he added.

Mercer conducted ESG ratings of the fund, while consultancy MJ Hudson Allenbridge also assisted.

The chair said the fund met with Fossil Free most recently in the summer, and expects another meeting. The scheme has also met with its members.

“Part of the reason for doing this is that we had a lot of lobbying from members of the pension scheme, and the unions wanted it as well,” he said. Poyser said he met with general union GMB’s Islington branch secretary George Sharkey before the decision, and that Caroline Russell, Islington’s sole Green Party councillor, was seen celebrating on the town hall’s steps as it was reached.

The fund will now “actively consider investing in renewable energy and green infrastructure”, according to a spokesperson.

However, the fund’s focus remains on the security of member benefits, and Poyser ruled out any further changes to its investment strategy over the next 12 months.

“I don’t want the whole obsession... [with] decarbonising to take over making the best possible decisions for the pension fund,” he added.

Are trustees required to consider ESG?

Russell said divesting from fossil fuels is in line with the fiduciary duty to the fund borne by her peers on the pensions board.

“It’s brilliant to see the councillors on the pensions committee taking a really prudent and responsible step to protect the assets in the fund from the risk of climate change,” she said.

Increased awareness of ESG was set in motion in 2014, when the Law Commission clarified that while trustees should not be compelled to take an ESG approach to investments, the long-term sustainability of companies should be factored into equity investment. That view was reinforced by the DWP regulations laid earlier this month.

“The important thing is that the council follows through,” Russell said. “It’s very, very complicated getting out of investments that have any kind of link to fossil fuels,” she added.

According to Russell, the fund’s decision to divest received the support of the Islington Pensioners’ Forum, who were unavailable for comment.

No distinction between fiduciary duty and ESG

Amanda Burdge, principal investment consultant at Quantum Advisory, does not draw a line between a trustee’s fiduciary duties and the goal of reducing carbon investment.

“Today heavy polluters do not necessarily have a ‘carbon effect’ priced into their share price, but in a rapidly changing, uncertain and volatile world it is not too difficult to see the impact that any change in pricing could have on these polluters,” she said.

“Moving now to a lower-carbon approach could potentially reduce this risk for pension schemes and perhaps encourage change in even the heaviest of polluters who find themselves increasingly excluded from portfolios,” she added.

Michael Johnson, a council worker and member of the pension fund, echoed Russell’s concerns over the investment risk carried by fossil fuels.

According to the Central Intelligence Agency’s World Factbook, known coal deposits on Earth are predicted to run out in 2088. Oil reserves are expected to be depleted in 2052.

Meanwhile, the UK market for socially responsible investment is expected to grow by 173 per cent to reach £48bn by 2027, according to research conducted by Triodos Bank, a sustainable investment-focused bank.

“I don’t want my pension to become worthless, as oil, coal and gas companies become obsolete, so I welcome Islington’s decision to ditch these investments,” Johnson said.

Campaigning pays off

Fossil Free describes itself as “a global campaign led by local groups” that campaigns for a transition to renewable energies, divestment from fossil fuels and the prevention of new fossil fuel projects. Individual chapters have had varying degrees of success in pressuring their local councils into divestment.

Fossil Free Islington campaigner Hannah Staab met Poyser, his predecessor Richard Greening, and vice-chair Andy Hull on “around 10” occasions to discuss the Islington fund’s investment strategy. The group has been lobbying Islington for three years.

“Earlier this year we handed in a petition that had 1,000 signatures of people living and working in the borough to the council, to show there’s public support for the issue as well,” Staab said. The petition currently has 1,069 signatures.

“It was at the last pension sub committee meeting [on June 26] when they verbally confirmed to us that they were going to have this process [of divestment]”, she added.

Divestment not always the answer

In June, the DWP published proposals that included the expectation of trustees to produce a statement detailing how they take account of scheme members’ ethical views.

While this idea has since been scrapped, schemes will still have to publish more detailed statements of investment principles from October next year.

Luke Fletcher, senior analyst at environmental data provider CDP, said it is important for schemes to understand the differences between various types of fossil fuels.

“A lot of people see, potentially, demand for oil being eroded by electric vehicles, maybe peaking in the mid-to-late 2020s. But then of course, gas might have this role to play as a bit of a bridging fuel to displace thermal coal and electricity generation,” he said.

“I think it is important sometimes not to just group fossil fuels altogether,” he added.

DWP scraps plans for schemes to check members’ ethical views

Controversial plans by the government to force trustees to outline how they have taken members’ ethical views into account in their investment strategies have been scrapped, it was revealed on September 17.

In the past six years, 837 institutions and over 58,000 individuals with more than $6tn (£4.3tn) of assets have made commitments to divest from fossil fuels, according to campaign group ShareAction.

Fletcher recognised the benefits of remaining invested in some fossil fuel companies and using shareholder rights to influence corporate strategy.

“Perhaps if you did divest you may lose some of that influence. But then you are also sending a signal to the market,” he said.