A radical change in investment strategy is underway at the Royal Borough of Greenwich Pension Fund, as it introduces new asset buckets for diversified alternatives and multi-asset strategies.

The popularity of multi-asset allocations has mushroomed over recent years, with diversified growth funds in particular witnessing a fivefold increase in investments since 2010, according to May data from consultancy Punter Southall.

However, the more niche area of diversified alternatives is at a comparatively nascent stage in the cycle for pension fund investors and reflects schemes’ desire for stronger growth but with lower volatility.

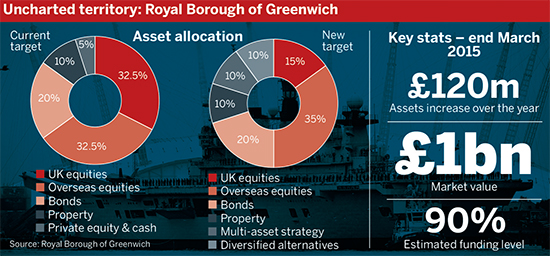

The Greenwich scheme, which earlier this year passed the £1bn assets mark, will target 10 per cent each in diversified alternatives and the multi-asset strategies.

At the same time it will do away with its separate private equity-cum-cash allocation of 5 per cent, as well as cut its UK equity target by more than half to 15 per cent, the latest annual report shows.

Councillor Don Austen, chair of the pension fund investment administration panel, said the fund would be hiring asset managers for the two new strategies, as well as for equities.

“This will help to ensure that the fund remains protected through diversification, but continues to be growth-focused to meet its defined benefit obligation,” he said in the report.

This will help to ensure that the fund remains protected through diversification, but continues to be growth-focused to meet its defined benefit obligation

Don Austen, Royal Borough of Greenwich

A spokesperson from the Greenwich fund said the new mandates will be funded from the existing equity portfolios, adding: “We expect to reduce UK equity exposure to approximately £150m.

“It is anticipated that the new £700m allocation will be allocated between four managers, with the search beginning in October 2015.”

Two key decisions were taken before the year end, which helped to mitigate against some of the volatility seen during the summer.

The spokesperson said: “In the knowledge that the fund wished to reduce its exposure to UK equities, which had seen a 6.5 per cent increase in one month alone and the time lag to actual restructure, it was deemed prudent to sell £50m of UK equities, realising a gain of almost £14m.”

In a second move, the fund switched half of its bond portfolio from UK aggregate bonds to a global multi-asset credit fund, gaining £37m.

While multi-asset allocations have seen a steady rise in popularity, Christian Howells, head of investment specialists in Aberdeen Asset Management’s solutions team, said diversified alternatives could be in the early stages of a similar development.

“Diversified growth funds are still an area that is seeing significant influx, in a way that I think diversified alternatives are not. But I think it will grow more as time goes on. I think it’s in an earlier part of its lifecycle if you like,” he said.

Know what you’re buying

The biggest advantage of a diversified alternatives investment, Howells said, was the move away from traditional markets.

This is one of the arguments people use for keeping these things separate; that they would rather go out and find an expert in each strategy than accept average across a wide range of different strategies

Toby Goodworth, bfinance

But he added that on the flip-side, “along with that comes a lot more requirement for research and understanding of the kind of things you are accessing”.

“Either they need more in-house resource and sophistication, or they need to outsource it to somebody who can do that, whether it’s a consultant or manager or some combination of those,” he cautioned.

An allocation to diversified alternatives is best suited to mid-to-large investors, Howells said, noting that very large investors have enough in-house capability to look after alternatives themselves, while smaller investors would be unable to appoint a manager for a standalone allocation.

Toby Goodworth, head of risk management at investment consultancy bfinance, said diversified alternatives could include allocations to individual single managers “or it could be a one-stop shop”.

However, he said in the case of the latter the question is whether a single manager can deliver on all the alternatives included in a diversified pot.

He added: “There are certainly managers out there that are very good in a wide range of strategies, but I think the more you encompass, the harder it is to be an expert in all of those.

“This is one of the arguments people use for keeping these things separate; that they would rather go out and find an expert in each strategy than accept average across a wide range of different strategies.”