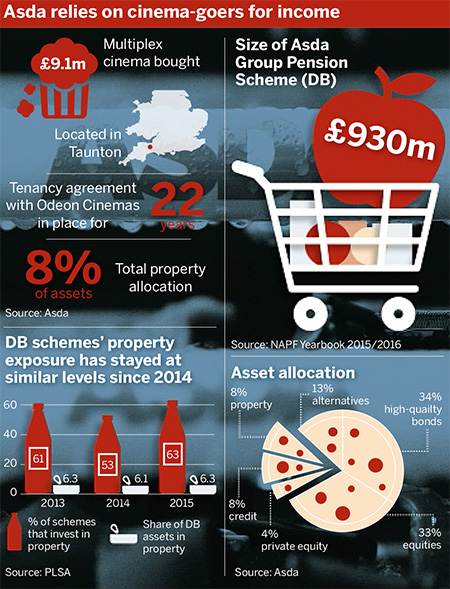

Asda Pension Fund has bought a £9.1m multiplex cinema as part of an ongoing property programme, as schemes continue to lap up real assets for their portfolios.

Taunton and a cinema are not the most obvious option

Roger Mattingly, Pan Trustees

In recent years, low interest rates have pushed pension funds towards property and infrastructure – known as real assets – in search of yield. However, competition for these assets has in turn led to schemes seeking out less conventional properties to invest in

The property has a rental agreement with Odeon Cinemas for the next 22 years, with rent rising annually in line with the retail price index but limited to between 1 per cent and 5 per cent.

A spokesperson for the fund said: “The purchase in Taunton is part of a long-established property programme within the Asda Pension Fund.”

The programme started in the mid-1990s, and property now makes up 8 per cent of the fund’s asset allocation.

Property’s popularity

Pension funds have increasingly been investing in real assets such as property and infrastructure in recent years, said Andrew Jones, chief executive of property investment company LondonMetric, which sold the building to the Asda fund.

“One thing we’ve been seeing over the last couple of years is increased appetite across [UK pension schemes],” he said. “Pension funds are some of the more active players.”

Schemes typically appoint an expert to run their property mandate and find potential investments, Jones added.

“They’re very specific in what they’re looking for,” he said, adding that the focus was mainly on properties valued at between £5m and £15m, in good locations, with long leases and attractive yields.

The search for yield

As interest rates have remained low, schemes have turned to real assets for a more attractive level of yield. Jones said reliability was a major factor among schemes looking to invest.

“They’re looking to these long-term... and hopefully growing income streams,” he said. “They’re not trying to asset manage per se, the real objective here is that dependable, predictable [income].”

The size of the interested schemes also allows them to move more quickly than some other types of investors, which can find themselves hampered by the need to raise money to complete a deal.

“They’re not looking to take out debt,” Jones said. “No need to wait for bank approval.”

The cinema was an attractive investment in part because of its single lease, Jones said, which reduced the amount of due diligence necessary.

However, Roger Mattingly, director at professional trustee company Pan Trustees, said both the type of asset and its location were unusual and possibly part of an effort to diversify further within the property portfolio.

He said he had never seen a pension fund investing in a cinema. “Retail outlets and complexes aren’t totally uncommon, but a multiplex cinema isn’t something I’ve come across before.”

Mattingly added this could mean the investment offers additional diversification to the property portfolio. “Taunton and a cinema are not the most obvious option,” he said.

Nicola Ralston, director at PiRho Investment Consulting, said the search for yield sparked by low interest rates has led to schemes broadening their horizons when looking for assets to invest in.

“The search for yield is driving investors to look at investments they might not have looked at otherwise,” she said. “Investors are being more open-minded in what they’re prepared to look at.”

“It seems to me consistent with the general trend to look at... less mainstream assets across the whole piece,” she added.

While pension funds often seek out property as a diversifier, she said, “they also look at property in some cases to try to be a quasi long-term income match for liabilities, if you can get a growing income over the long run.”